SuperCMS 当前页面数据:

site-> {"name":"缠说・股经","domain":"cms.foryet.com","email":"ionce@163.com","wx":null,"icp":"京ICP备14010346号","code":"","title":"缠说• 股经","keywords":"通达信,同花顺,指标公式,选股公式,量化交易,量化炒股,量化策略,股票,财经,证券,金融,港股,行情,基金,债券,期货,外汇,科创板,保险,银行,博客,股吧,财迷,论坛,数据,stock,quote,news,fund,bank,blog,data,bbs,股票,投资,交易,行情,上市公司,大盘,上证指数,基金,直播,股评,荐股,博客 ,外汇,黄金,期货,港股,美股, 财经日历,银行,新闻, 证券","description":"股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享,“缠中说禅”博文。","json":""}

nav-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1,"createdAt":"01-27"}]

category-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1,"createdAt":"01-27"}]

friendlink-> [{"title":"SuperCMS官网","link":"https://cms.foryet.com"}]

static_url-> /web/default

frag--->{"weixinerweima":"<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\"></p>","PowerBy":"<p style=\"text-align: center; margin-top: 8px;\">Powder By <a href=\"http://cms.foryet.com\" target=\"_blank\" rel=\"noopener\">SuperCMS v3.0.14</a></p>","site_introduce":"<p><span style=\"font-size: 16px;\">股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享。欢迎扫码交流。</span></p>\n<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>"}

ad--->

tag--->[{"id":5,"name":"经验交流","path":"jingyanjiaoliu","count":20},{"id":6,"name":"技术指标","path":"jishuzhibiao","count":16},{"id":3,"name":"指标公式","path":"formula","count":10},{"id":4,"name":"选股公式","path":"xgformula","count":5}]

position------>[{"id":3,"name":"指标公式","path":"/formula"}]

cate------>{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"}

list------>

recommend------>[]

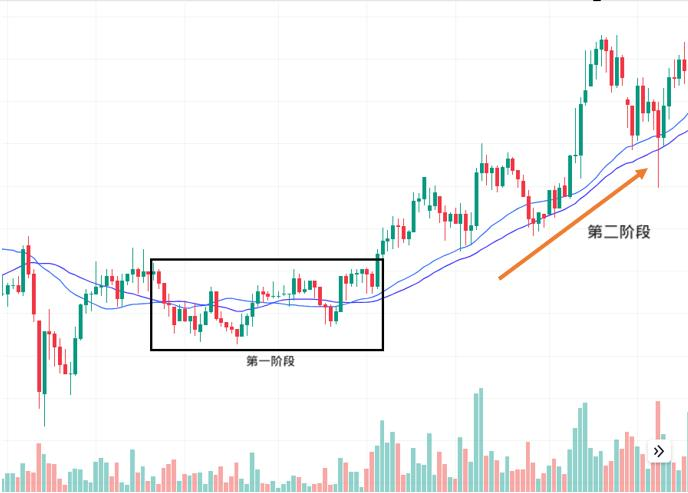

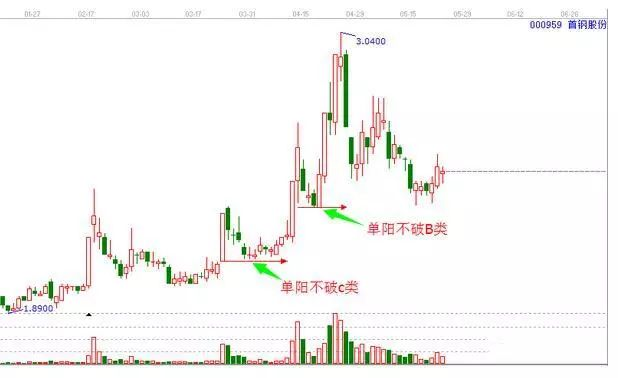

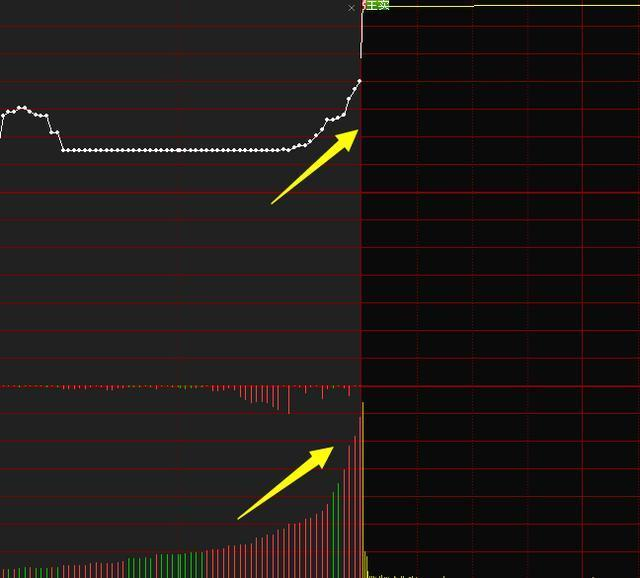

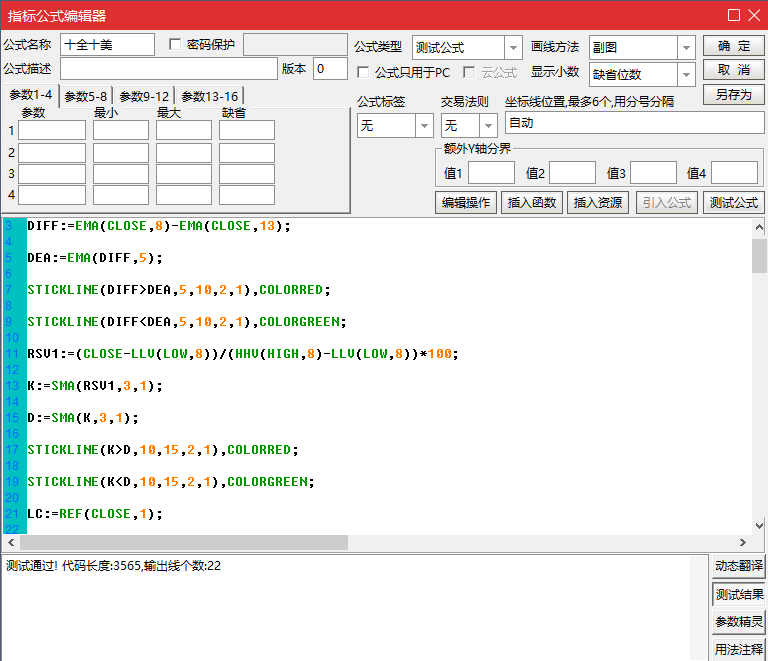

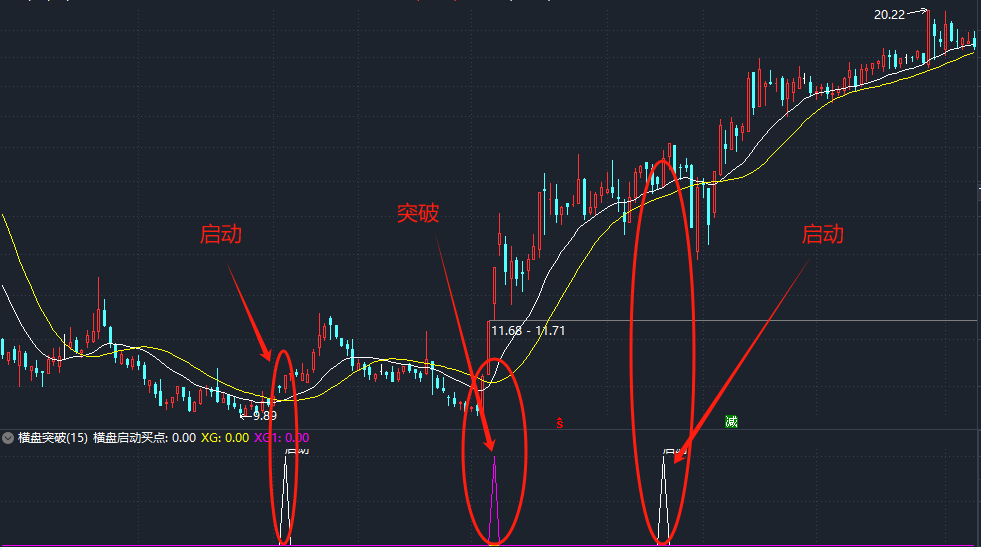

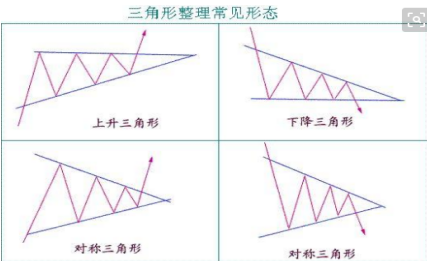

hot------>[{"id":10,"title":"最强势的反转形态——“出水芙蓉”,经常出现中线大牛股第一安全买点!","path":"/formula"},{"id":6,"title":"一文通过案例将MACD指标讲清楚","path":"/formula"},{"id":34,"title":"经典的形态“美人肩”,主图公式及选股要点","path":"/formula"},{"id":28,"title":"【转折K线】+【五大金叉共振】潜伏波段牛选股指标公式,捕捉股市起涨拐点牛股","path":"/formula"},{"id":43,"title":"“N型战法”, 大平台突破后缩量回踩浅调模型及指标公式源码","path":"/formula"},{"id":44,"title":"VCP形态第二阶段的入场策略及选股公式","path":"/formula"},{"id":37,"title":"精品指标“十全十美”,十个模型(MACD、KDJ、RSI、LWR、BBI、MTM等)共同指向市场趋势,指标共振信号与市场趋势","path":"/formula"},{"id":36,"title":"长期横盘突破战法,及指标公式","path":"/formula"},{"id":35,"title":"“三角形”整理形态的秘密,体现多空力量博弈,及主图公式","path":"/formula"},{"id":33,"title":"经典形态头肩底原理、主图公式及选股公式","path":"/formula"}]

imgs------>[{"id":44,"title":"VCP形态第二阶段的入场策略及选股公式","shortTitle":"","img":"https://chanshuo.onrender.com/upload/image_20240517074016.png","createdAt":"2026-01-27T10:13:41.000Z","description":"本文将要说明,为什么VCP型态的唯一要求是选择在第二阶段进场布局呢?","pinyin":"formula","name":"指标公式","path":"/formula"},{"id":43,"title":"“N型战法”, 大平台突破后缩量回踩浅调模型及指标公式源码","shortTitle":"","img":"https://chanshuo.onrender.com/upload/image_20240425071757.png","createdAt":"2026-01-27T09:29:03.000Z","description":"“N型战法”,也称作单阳不破,意思就是说,在一阳之后所产生的数日调整,其每个低点都不会低于前面所拉出阳线的低点,一阳后几天内的每日成交量不能超过一阳当日量的一半(长阳后越缩量越好)。","pinyin":"formula","name":"指标公式","path":"/formula"},{"id":41,"title":"“MACD+布林线”双剑合璧,洞察市场的动能和波动","shortTitle":"","img":"https://chanshuo.onrender.com/upload/image_20240326023749.png","createdAt":"2026-01-27T09:18:16.000Z","description":"MACD是一个有效的趋势跟踪和动量指标,BOLL布林线可以观察波动的周期性,两个指标结合使用可以帮助进行高概率交易,因为它们可以衡量现有趋势的方向、强度、波动性以及动能","pinyin":"formula","name":"指标公式","path":"/formula"},{"id":40,"title":"“中短线波段”指标,一个指标搞定抄底,逃顶","shortTitle":"","img":"https://chanshuo.onrender.com/upload/b08e7a877cbfd78e3b0b8e8bd3c68c5.png","createdAt":"2026-01-27T09:14:51.000Z","description":"本期带来的是“中短线波段”指标。本指标无未来函数、信号不漂移。","pinyin":"formula","name":"指标公式","path":"/formula"},{"id":39,"title":"如何用“集合竞价打板”轻松选出涨停股?选择这类股,将赚到怀疑人生(附指标公式源码)","shortTitle":"","img":"https://chanshuo.onrender.com/upload/image_20240414075308.png","createdAt":"2026-01-27T09:11:49.000Z","description":"在实战中,集合竞价具有重要的定性作用,它从总体上反映了多空双方或做多或做空的倾向,由此可以了解多空基本意愿。具体操作中,主要是与昨日集合竞价和收盘价相比,看开盘高低和量能变化。","pinyin":"formula","name":"指标公式","path":"/formula"}]