SuperCMS 当前页面数据:

site-> {"name":"缠说・股经","domain":"cms.foryet.com","email":"ionce@163.com","wx":null,"icp":"京ICP备14010346号","code":"","title":"缠说• 股经","keywords":"通达信,同花顺,指标公式,选股公式,量化交易,量化炒股,量化策略,股票,财经,证券,金融,港股,行情,基金,债券,期货,外汇,科创板,保险,银行,博客,股吧,财迷,论坛,数据,stock,quote,news,fund,bank,blog,data,bbs,股票,投资,交易,行情,上市公司,大盘,上证指数,基金,直播,股评,荐股,博客 ,外汇,黄金,期货,港股,美股, 财经日历,银行,新闻, 证券","description":"股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享,“缠中说禅”博文。","json":""}

nav-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1}]

category-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1}]

friendlink-> [{"title":"SuperCMS官网","link":"https://cms.foryet.com"}]

static_url-> /web/default

frag--->{"weixinerweima":"<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\"></p>","PowerBy":"<p style=\"text-align: center; margin-top: 8px;\">Powder By <a href=\"http://cms.foryet.com\" target=\"_blank\" rel=\"noopener\">SuperCMS v3.0.14</a></p>","site_introduce":"<p><span style=\"font-size: 16px;\">股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享。欢迎扫码交流。</span></p>\n<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>"}

tag--->[{"id":5,"name":"经验交流","path":"jingyanjiaoliu","count":20},{"id":6,"name":"技术指标","path":"jishuzhibiao","count":16},{"id":3,"name":"指标公式","path":"formula","count":10},{"id":4,"name":"选股公式","path":"xgformula","count":5}]

position------>[{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"}]

navSub------>

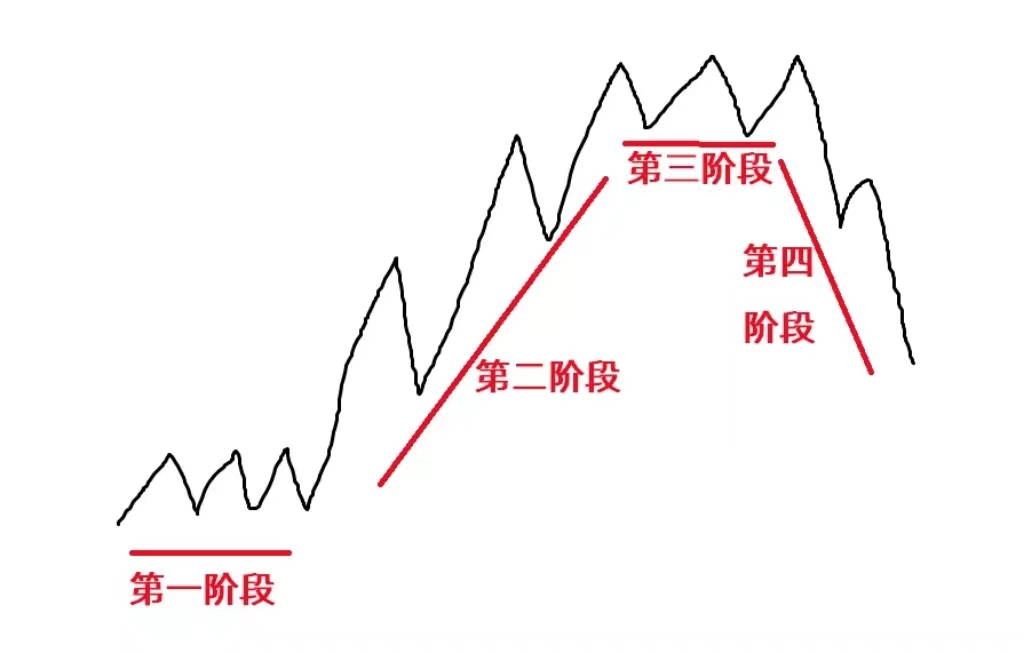

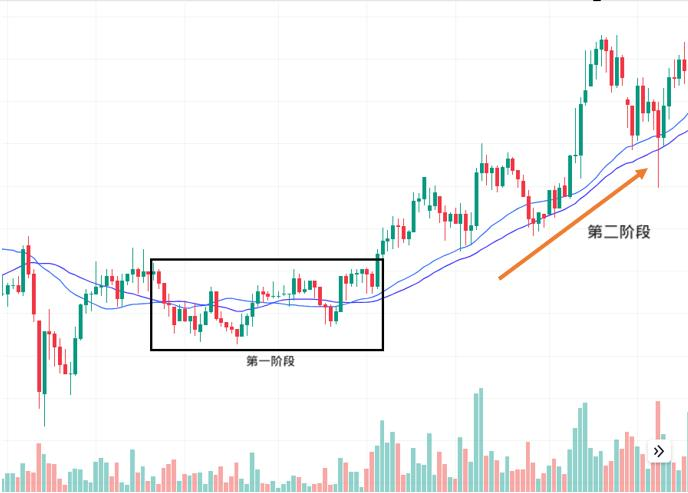

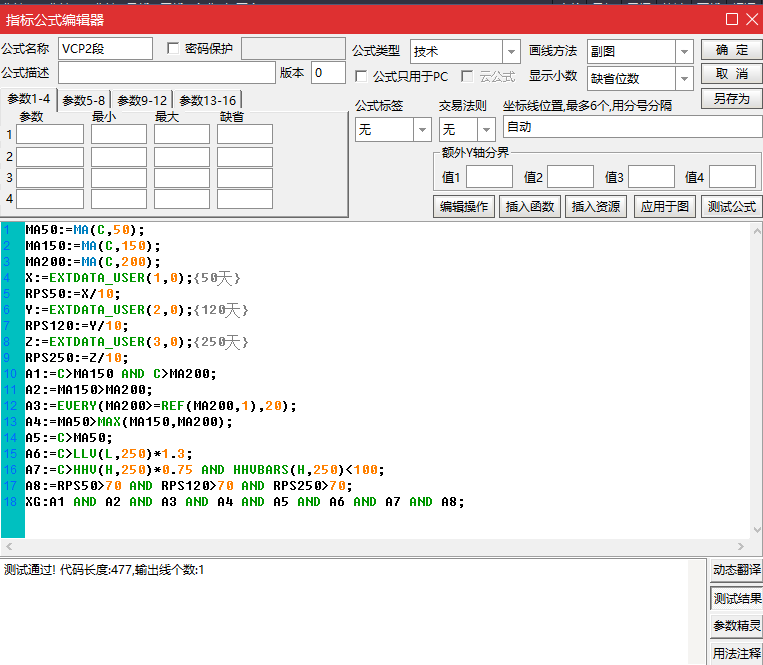

article------>{"id":44,"cid":3,"subCid":"","title":"VCP形态第二阶段的入场策略及选股公式","shortTitle":"","tagId":"6,3,4","attr":"4,2","articleView":"","source":"","author":"","description":"本文将要说明,为什么VCP型态的唯一要求是选择在第二阶段进场布局呢?","img":"https://chanshuo.onrender.com/upload/image_20240517074016.png","content":"<p>上篇文章<a href=\"/articles/article-21.html\" title=\"VCP形态\">《全美交易冠军马克·米勒维尼的核心交易模式VCP形态的指标公式及选股公式》</a>我们对马克·米勒维尼的核心交易模式的VCP形态进行了详细的说明,而本文将要说明,为什么VCP型态的唯一要求是选择在第二阶段进场布局呢?</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/3bf4ad823eb28c54fb34db7d2897295.jpg\" alt=\"3bf4ad823eb28c54fb34db7d2897295.jpg\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<h2 id=\"h0\">股票的四个阶段</h2>\n<p>对于股票运行的阶段,不同的股票分析方法有着不同的划分方式。从传统的主力运作分析,可以分为吸筹、洗盘、试盘、拉升、出货五个阶段。在波浪理论中,一个完整的上升或下降周期包含8浪(其中5浪是主浪、3浪是调整浪)。在缠论中,有三类买卖点。在威科夫方法中,一个循环分为吸筹、上涨、派发和下跌四个阶段。在《股票魔法师——纵横天下股市的奥秘》这本书中,作者马克·米勒维尼继承了史丹·温斯坦在《笑傲牛熊》对于股票所处阶段的划分,分为四个阶段:第一阶段(忽略时期:巩固)、第二阶段(突围时期:加速)、第三阶段(到顶时期:分配利润)、第四阶段(衰败时期:投降)。</p>\n<p>第一阶段属于公司股票被忽视、市场不愿意为其付出金钱的阶段,此时公司的财务表现可能不稳定,外界对其未来存在疑问。在这个阶段,股票很难摆脱困境吸引机构投资者的关注,并且可能持续数月甚至数年。马克·米勒维尼认为应该避免购买处于第一阶段的股票。</p>\n<p>第二阶段属于公司已经开始吸引机构投资者并且股价进入上升趋势的阶段。在这个阶段,股价增长可能会受到一些惊喜的新闻点燃,股价可能会开始快速上涨,伴随着交易价格和交易量的明显增加。如果公司能保持高盈利并连续报告出令人印象深刻的净利润,股价的增长率应该会继续加速,会吸引大量投资者。</p>\n<p>第三阶段属于股票逐渐从强势购买者手中转移到弱势购买者手中的阶段。在这个阶段,股价增长的力道逐渐减弱,尽管净利润可能仍在增长,但增速逐渐放缓,导致股价的攀升趋势开始下滑,同时股票的波动性逐渐增加。尽管净利润一直超出预期,但随着时间的推移,股价会在净利润增速减缓或者未能达到预期时出现转向下跌的情况。</p>\n<p>第四阶段属于股票从上涨的顶峰转为下跌的阶段。在这个阶段,公司净利润增速减缓,可能会出现负面新闻报道,最终导致之前上涨的势头达到顶峰后转为下跌。净利润预期被下调,股票面临更大的下跌压力,卖出浪潮可能持续相当长时间。第四阶段的股价和交易量特征与第二阶段相反,交易量高企且下跌的日子多于上涨的日子。马克·米勒维尼认为应该避免购买处于第四阶段的股票。</p>\n<h2 id=\"h1\">何时进场</h2>\n<p>CPT Markets分析师提到,筹码由弱者手上转移到强者会形成多个波浪,即所谓的「收缩」。而这个收缩幅度会随着时间越来越小,这代表着卖压逐渐减弱,筹码趋于稳定,而当VCP型态收缩到最后,会出现成交量萎缩的现象,在此,投资人应留意「若出现强劲攻击量并突破前高,创下新高点,此时往往会是一绝佳的买点。</p>\n<p>在交易市场中的投资人往往会忽略甚至是误解交易目标的根本意义,其实投资人的目标并非追求最低或最便宜的价格,而是寻找「正确」的进场时机,而所谓的正确时机,即是在目标即将大幅上涨时进场的价格。为什么VCP型态的唯一要求是选择在第二阶段进场布局呢?</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240517074016.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>第二阶段的入场策略实质上是顺应趋势进行交易,当有大量买盘的出现(机构买盘介入)将能有效地支撑了价格,而在这种情况下,明显的价格上升必伴随着成交量的增加,形成价涨量增/价跌量缩的现象,简而言之,不管你是使用日线还是周线图,一旦价格上涨,成交量都会显著扩大;反之,当价格回调时,成交量则相对缩小。</p>\n<p>因此,在考虑买进目标之前,投资者必须确认已经看到一波上升势头,一旦进入第二阶段,目标将呈快速暴涨趋势。需要注意的是,这可能仅仅是暴涨起点,确认第二阶段后,特别是在该目标持续有利多消息释出,买盘自然会持续涌入,推动目标价格继续上涨。CPT Markets分析师分享七项要点供读者确认该目标已 过渡至第二阶段:</p>\n<p>1、股价在150日和200日均线上方;</p>\n<p>2、150日均线在200日均线上方;</p>\n<p>3、200日均线至少涨了1个月(多数情况下,涨4-5个月更好);</p>\n<p>4、50日均线在150日及200日均线上方;</p>\n<p>5、当前股价在50日均线上方;</p>\n<p>6、当前股价比最近一年最低股价至少高30%;</p>\n<p>7、当前价格至少处在最近一年最高价的75%以内(距最高价越近越好);</p>\n<p>8、相对动力排名不低于70,最好在80、90左右。</p>\n<h2 id=\"h2\">指标公式</h2>\n<p>按照上面8个条件分别写出来就可以了。对于第8个条件,书中是根据《每日投资报》公布的排名,我们没有这个数据,就使用RPS相对强度指标进行排名。</p>\n<p><strong>公式源码</strong></p>\n<pre><code class=\"hljs language-css\">MA50:=<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">50</span>);\nMA150:=<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">150</span>);\nMA200:=<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">200</span>);\nX:=<span class=\"hljs-built_in\">EXTDATA_USER</span>(<span class=\"hljs-number\">1</span>,<span class=\"hljs-number\">0</span>);{<span class=\"hljs-number\">50</span>天}\nRPS50:=X/<span class=\"hljs-number\">10</span>;\nY:=<span class=\"hljs-built_in\">EXTDATA_USER</span>(<span class=\"hljs-number\">2</span>,<span class=\"hljs-number\">0</span>);{<span class=\"hljs-number\">120</span>天}\nRPS120:=Y/<span class=\"hljs-number\">10</span>;\nZ:=<span class=\"hljs-built_in\">EXTDATA_USER</span>(<span class=\"hljs-number\">3</span>,<span class=\"hljs-number\">0</span>);{<span class=\"hljs-number\">250</span>天}\nRPS250:=Z/<span class=\"hljs-number\">10</span>;\nA1:=C>MA150 AND C>MA200;\nA2:=MA150>MA200;\nA3:=<span class=\"hljs-built_in\">EVERY</span>(MA200>=<span class=\"hljs-built_in\">REF</span>(MA200,<span class=\"hljs-number\">1</span>),<span class=\"hljs-number\">20</span>);\nA4:=MA50><span class=\"hljs-built_in\">MAX</span>(MA150,MA200);\nA5:=C>MA50;\nA6:=C><span class=\"hljs-built_in\">LLV</span>(L,<span class=\"hljs-number\">250</span>)*<span class=\"hljs-number\">1.3</span>;\nA7:=C><span class=\"hljs-built_in\">HHV</span>(H,<span class=\"hljs-number\">250</span>)*<span class=\"hljs-number\">0.75</span> AND <span class=\"hljs-built_in\">HHVBARS</span>(H,<span class=\"hljs-number\">250</span>)<<span class=\"hljs-number\">100</span>;\nA8:=RPS50><span class=\"hljs-number\">70</span> AND RPS120><span class=\"hljs-number\">70</span> AND RPS250><span class=\"hljs-number\">70</span>;\nXG:A1 AND A2 AND A3 AND A4 AND A5 AND A6 AND A7 AND A8;\n</code></pre>\n<p>注:本公式指标公式与选股公式相同。</p>\n<p><strong>公式截图</strong></p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240520012307.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>注意:RPS指标需要提前设置并且用扩展数据管理器计算好数据,每天刷新,不然没有结果,因为公式中的EXTDATA_USER需要引用扩展数据管理器中的数据。</p>\n<p>第二阶段趋势模板选出的股票只是进入了观察名单,需要等待出现稳固期,比如VCP形态等。根据马克·米勒维尼的观点,正确的时机应该是股价刚刚从稳固期中走出,价格开始上涨之时。</p>\n<p>关于RPS指标及相关设置,会在下一篇文章中进行说明,敬请关注。</p>\n<p> </p>\n<p> </p>\n<div class=\"column is-12\" style=\"text-align: center;\">\n<table style=\"border-collapse: collapse; width: 68.6927%; height: 300.782px; border-width: 0px; margin-left: auto; margin-right: auto;\" border=\"1\"><colgroup><col style=\"width: 50.2582%;\"><col style=\"width: 49.7418%;\"></colgroup>\n<tbody>\n<tr style=\"height: 19.5938px;\">\n<td style=\"text-align: center; border-width: 0px; height: 19.5938px;\" colspan=\"2\"><strong><span style=\"font-size: 16px;\">感谢您的捐赠(鞠躬) ❤️</span></strong></td>\n</tr>\n<tr style=\"height: 199.594px;\">\n<td style=\"text-align: center; border-width: 0px; height: 199.594px;\">\n<p><img src=\"//img.foryet.com/uploads/2026/0125_31014606929_wxPay.png\" alt=\"\" width=\"200\" height=\"171\"></p>\n</td>\n<td style=\"border-width: 0px; height: 199.594px;\"><img src=\"//img.foryet.com/uploads/2026/0125_31014634042_zfbPay.png\" alt=\"\" width=\"158\" height=\"180\" style=\"display: block; margin-left: auto; margin-right: auto;\"></td>\n</tr>\n</tbody>\n</table>\n</div>","status":0,"pv":2,"link":"","createdAt":"2026-01-27T10:13:41.000Z","updatedAt":"2026-01-27T10:57:36.000Z","field":{}}

article.tags------>

news------>[]

hot------>[]

imgs------>[]

pre------>{"id":43,"title":"“N型战法”, 大平台突破后缩量回踩浅调模型及指标公式源码","name":"指标公式","path":"/formula"}

next------>