SuperCMS 当前页面数据:

site-> {"name":"缠说・股经","domain":"cms.foryet.com","email":"ionce@163.com","wx":null,"icp":"京ICP备14010346号","code":"","title":"缠说• 股经","keywords":"通达信,同花顺,指标公式,选股公式,量化交易,量化炒股,量化策略,股票,财经,证券,金融,港股,行情,基金,债券,期货,外汇,科创板,保险,银行,博客,股吧,财迷,论坛,数据,stock,quote,news,fund,bank,blog,data,bbs,股票,投资,交易,行情,上市公司,大盘,上证指数,基金,直播,股评,荐股,博客 ,外汇,黄金,期货,港股,美股, 财经日历,银行,新闻, 证券","description":"股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享,“缠中说禅”博文。","json":""}

nav-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1,"createdAt":"01-27"}]

category-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1,"createdAt":"01-27"}]

friendlink-> [{"title":"SuperCMS官网","link":"https://cms.foryet.com"}]

static_url-> /web/default

frag--->{"weixinerweima":"<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\"></p>","PowerBy":"<p style=\"text-align: center; margin-top: 8px;\">Powder By <a href=\"http://cms.foryet.com\" target=\"_blank\" rel=\"noopener\">SuperCMS v3.0.14</a></p>","site_introduce":"<p><span style=\"font-size: 16px;\">股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享。欢迎扫码交流。</span></p>\n<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>"}

tag--->[{"id":5,"name":"经验交流","path":"jingyanjiaoliu","count":20},{"id":6,"name":"技术指标","path":"jishuzhibiao","count":16},{"id":3,"name":"指标公式","path":"formula","count":10},{"id":4,"name":"选股公式","path":"xgformula","count":5}]

position------>[{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"}]

navSub------>

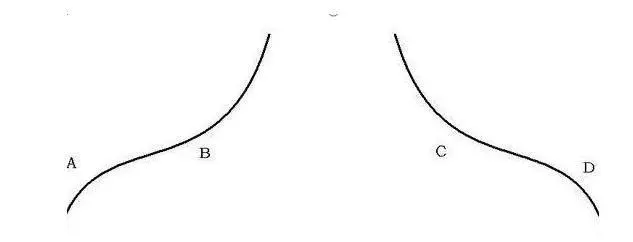

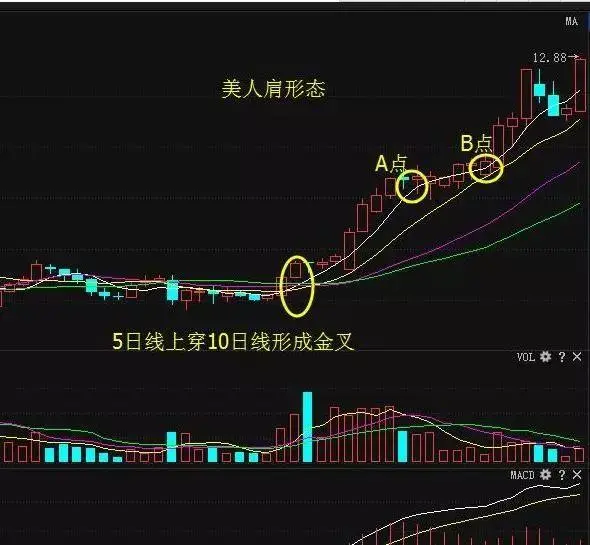

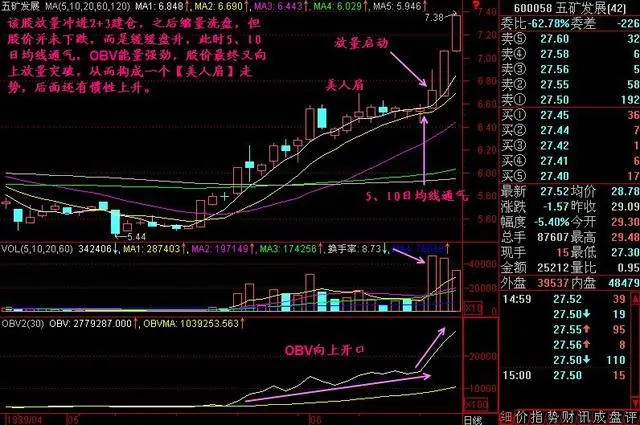

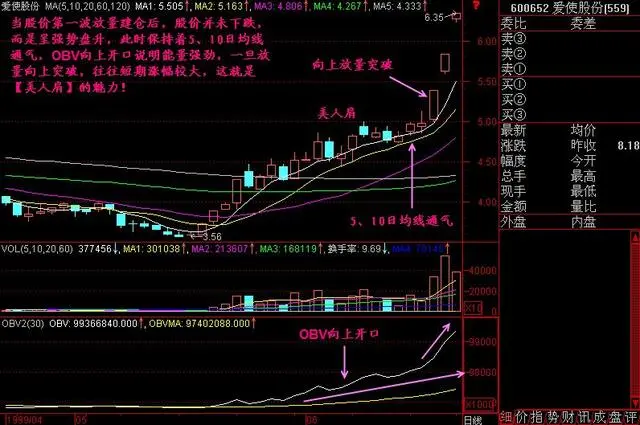

article------>{"id":34,"cid":3,"subCid":"","title":"经典的形态“美人肩”,主图公式及选股要点","shortTitle":"","tagId":"4,3,6,5","attr":"1,2,4","articleView":"","source":"","author":"","description":"美人肩形态是一种强势的建仓表现,该建仓模式最大的特征就是“洗盘时股价不跌,甚至还能涨”!说明庄家买入该股的迫切心情,只要后期股价突破肩膀的高点连线,则股价加速上涨可期!","img":"https://chanshuo.onrender.com/upload/image_20240320020245.png","content":"<h2 id=\"h0\">什么“美人肩”</h2>\n<p>美人肩形态是一种强势的建仓表现,该建仓模式最大的特征就是“洗盘时股价不跌,甚至还能涨”!说明庄家买入该股的迫切心情,只要后期股价突破肩膀的高点连线,则股价加速上涨可期!“美人肩”是一种强势庄股特有的形态,它表明的是主力对该股非常的看好,舍不得让股价回落下来给其他人逢低吸纳的机会,他自己每天买一点就买上去了,同时也表明在市场上的浮动筹码极少。下图形象地展示了“美人肩”形态:</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240320020245.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>日线对于炒股的人而言是最基础的分析指标,如果掌握了一些看涨看跌的日线图组合形态就可以提前在票上涨之前进场,下跌之前抛出,很大程度上提高你的胜算。而“美人肩”形态是强势日K线的一种形像的表现,一旦这种形态出现,后市大概率会有极佳的表现。美人肩形态为强庄股所特有,其昭示主力怜香惜玉,不忍股价回落、不忍他人染指,让股价高位震荡,洗出获利盘,然后放量拉升,不给人进场机会,这就是美人肩的内涵。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240320020757.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>如上图,A、B是上升美人肩,C、D是下跌美人肩。在K线图上,回档深了,B点如低于A点,就不美啦!如果想要寻找A点低于B点的走势,则要寻找5日均线与10日均线不粘合时的走势。我们要寻找的是A点低于B点的主升走势,即5日与10日均线不粘合的上升趋向,而C、D两点是空头排列阶段,不是我们关注的重点。</p>\n<h2 id=\"h1\">美人肩技术形态</h2>\n<p><strong>第一,</strong>美人肩是一种K线的形态,通常是主力大举建仓留下来的痕迹,这种形态每年都会碰到几十个,用心寻找总会发现的。</p>\n<p><strong>第二,</strong>美人肩的技术特征,五日均线和10均线必须要来回不断的形成金叉死叉。</p>\n<p><strong>第三,</strong>K线的前半段走势必须呈现拱形,只有这样才配叫美人肩,如果步是拱形,那就不是美人肩了。</p>\n<p><strong>第四,</strong>K线必须在60日均线之上,最好悬空,或者更加强势的美人肩,K线在30日均线之上,这样拉升起来的幅度就会变大。</p>\n<p><strong>第五,</strong>美人肩的底下就是盘整的部分的底下必须放量,因为美人肩是主力短时间强势建仓的结果,所以必须放量。</p>\n<p><strong>第六,</strong>美人肩拉升起来是很可怕的,涨幅通常在30个点以上。</p>\n<h2 id=\"h2\">最佳买点</h2>\n<p>当股价放量突破肩膀时,就是短线介入的最佳时机。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240320021826.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>成交量持续增加,股价趋势也转为上升,这是短中线最佳的买入信号。</p>\n<p>量增价增是正常的健康的结构,属于典型的多头行情,股价的上升趋势也是格外明显,短中期均线最佳的买入信号;</p>\n<p>其成交量持续增加,换手率相当积极,缩量横盘,很可能是主动买入进货,是一个多头排列市场,此刻是滚动操盘盈利的最佳时机。</p>\n<p>量增价升是最常见的多头主动进攻模式,建议积极进场买入与庄共舞,一般这种多头行情不会轻易得停下来,说明价格的上升得到了成交量增加的支撑。</p>\n<p>后市将继续看好,此时投资者应积极买入或者加仓。</p>\n<h2 id=\"h3\">战法的要点:</h2>\n<p>1、股价已启动,进入盘整阶段;启动时,最好有涨停板。</p>\n<p>2、盘整时,股价阴阳交错,重心上移,肩部(A点)不得高于颈部(B点)。</p>\n<p>3、股价启动时5日线已金叉10日线,盘整时不得粘合,通风透气。</p>\n<p>4、股价启动时堆量,盘整时缩量,再度突破时需放量。</p>\n<p>5、OBV能量潮之曲线需开口向上,不可相互纠缠。</p>\n<h2 id=\"h4\">主图公式</h2>\n<pre><code class=\"language-“美人肩”主图公式 hljs language-css\">\nMA5:<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">5</span>);\nMA10:<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">10</span>);\nMA20:<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">20</span>);\nMA60:<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">60</span>);\nJC:=<span class=\"hljs-built_in\">CROSS</span>(MA5,MA10);{<span class=\"hljs-number\">5</span>日、<span class=\"hljs-number\">10</span>日均线金叉}\nT:=<span class=\"hljs-built_in\">BARSLAST</span>(JC);{金叉以来的周期数}\nLL:=<span class=\"hljs-built_in\">LLV</span>(L,T+<span class=\"hljs-number\">5</span>);{金叉前的低点}\nMAVOL:=<span class=\"hljs-built_in\">SUM</span>(V,T)/T;{金叉以来均量}\nMAV5:=<span class=\"hljs-built_in\">MA</span>(V,<span class=\"hljs-number\">5</span>);{<span class=\"hljs-number\">5</span>日均量}\nA1:=(C-LL)/LL*<span class=\"hljs-number\">100</span>><span class=\"hljs-number\">10</span> AND T><span class=\"hljs-number\">8</span> AND <span class=\"hljs-built_in\">EVERY</span>(MA5>MA10,T) AND C>MA60;\n{低点以来涨幅大于<span class=\"hljs-number\">10%</span>,金叉以来周期数大于<span class=\"hljs-number\">8</span>,金叉以来<span class=\"hljs-number\">5</span>日均线都在<span class=\"hljs-number\">10</span>日均线之上,收盘价在<span class=\"hljs-number\">60</span>日均线之上}\nA2:=<span class=\"hljs-built_in\">COUNT</span>(<span class=\"hljs-built_in\">ABS</span>(C-O)/C*<span class=\"hljs-number\">100</span><<span class=\"hljs-number\">5</span>,<span class=\"hljs-number\">10</span>)>=<span class=\"hljs-number\">8</span> AND <span class=\"hljs-built_in\">REF</span>(<span class=\"hljs-built_in\">EVERY</span>((H-L)/L*<span class=\"hljs-number\">100</span><<span class=\"hljs-number\">8</span>,<span class=\"hljs-number\">10</span>),<span class=\"hljs-number\">1</span>);\n{最近大部分都是小阴小阳}\nA3:=<span class=\"hljs-built_in\">COUNT</span>((MA5-MA10)<<span class=\"hljs-built_in\">REF</span>(MA5-MA10,<span class=\"hljs-number\">1</span>),T)><span class=\"hljs-number\">3</span>;\n{金叉以来存在<span class=\"hljs-number\">3</span>个以上周期<span class=\"hljs-number\">5</span>日均线和<span class=\"hljs-number\">10</span>日均线收敛}\nA4:=<span class=\"hljs-built_in\">EXIST</span>(<span class=\"hljs-built_in\">EVERY</span>(MAV5<MAVOL,<span class=\"hljs-number\">2</span>),<span class=\"hljs-number\">5</span>) AND <span class=\"hljs-built_in\">REF</span>((C/<span class=\"hljs-built_in\">REF</span>(C,<span class=\"hljs-number\">5</span>)-<span class=\"hljs-number\">1</span>)*<span class=\"hljs-number\">100</span><<span class=\"hljs-number\">8</span>,<span class=\"hljs-number\">1</span>);\n{最近<span class=\"hljs-number\">5</span>天存在持续<span class=\"hljs-number\">2</span>天<span class=\"hljs-number\">5</span>日均量小于金叉以来均量,前<span class=\"hljs-number\">5</span>天涨幅小于<span class=\"hljs-number\">8</span>}\nA5:=C><span class=\"hljs-built_in\">REF</span>(<span class=\"hljs-built_in\">HHV</span>(H,T),<span class=\"hljs-number\">1</span>) AND C-O><span class=\"hljs-built_in\">REF</span>(<span class=\"hljs-built_in\">HHV</span>(C-O,<span class=\"hljs-number\">10</span>),<span class=\"hljs-number\">1</span>)*<span class=\"hljs-number\">0.7</span>;\n{突破金叉以来的高点出信号,K线的实体部分大于最近<span class=\"hljs-number\">10</span>天最大实体的<span class=\"hljs-number\">0.7</span>倍}\nAA:=A1 AND A2 AND A3 AND A4 AND A5;\nXG:=<span class=\"hljs-built_in\">FILTER</span>(AA,<span class=\"hljs-number\">20</span>);\nSTICKLINE(XG,H,L,<span class=\"hljs-number\">0</span>,<span class=\"hljs-number\">0</span>),COLORYELLOW;\nSTICKLINE(XG,O,C,<span class=\"hljs-number\">3</span>,<span class=\"hljs-number\">0</span>),COLORYELLOW;\nDRAWICON(XG,L,<span class=\"hljs-number\">11</span>);\n</code></pre>\n<p>免费下载“美人肩”主图公式</p>\n<p>链接: <a href=\"https://pan.baidu.com/s/13LnxRq6TENYC3MK8WIZoIg?pwd=g82w\">https://pan.baidu.com/s/13LnxRq6TENYC3MK8WIZoIg?pwd=g82w</a></p>\n<p>提取码: g82w</p>\n<h2 id=\"h5\">实战案例</h2>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240320023648.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>该股放量冲进2+3建仓,之后缩量洗盘,但股价并未下跌,而是缓缓盘升,此时5、10日均线通气。OBV能量强劲,股价最终又向上放量突破,从而构成一个【美人肩】走势,后面还有惯性上升。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240320023745.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>当股价第一波放量建仓后,股价并未下跌,而是呈强势盘升,此时保持着5、10日均线通气,OBV向上开口说明能量强劲,一旦放量向上突破,往往短期幅度较大,这就是【美人肩】的魅力!</p>\n<h2 id=\"h6\">注意事项</h2>\n<p>一个完美的美人肩,除了“形似”以外,还要有量的配合。近期的成交量放大,OBV曲线向上开口。</p>\n<p>股价在第一波放量建仓之后,往往进入缩量洗盘阶段,这个时候个股将出现分化,对于那些弱庄股将出现回档较深,5、10日均线死叉的情况,而有相当少部分的股票会出现股价并不下跌,缩量盘整或盘升的状态,这个时候5、10日均价线保持通气,只要能量注入,成交量放大,股价向上突破,这就构成了【美人肩】了。</p>\n<p>当然,美人肩C、D这一段是下跌中继段,感觉下跌趋缓了,思想麻痹了,错以为不会再跌了,这就中了“美人计”了,过了D点后的低位暴跌,其损失更大。</p>\n<p> </p>\n<p> </p>\n<div class=\"column is-12\" style=\"text-align: center;\">\n<table style=\"border-collapse: collapse; width: 68.6927%; height: 300.782px; border-width: 0px; margin-left: auto; margin-right: auto;\" border=\"1\"><colgroup><col style=\"width: 50.2582%;\"><col style=\"width: 49.7418%;\"></colgroup>\n<tbody>\n<tr style=\"height: 19.5938px;\">\n<td style=\"text-align: center; border-width: 0px; height: 19.5938px;\" colspan=\"2\"><strong><span style=\"font-size: 16px;\">感谢您的捐赠(鞠躬) ❤️</span></strong></td>\n</tr>\n<tr style=\"height: 199.594px;\">\n<td style=\"text-align: center; border-width: 0px; height: 199.594px;\">\n<p><img src=\"//img.foryet.com/uploads/2026/0125_31014606929_wxPay.png\" alt=\"\" width=\"200\" height=\"171\"></p>\n</td>\n<td style=\"border-width: 0px; height: 199.594px;\"><img src=\"//img.foryet.com/uploads/2026/0125_31014634042_zfbPay.png\" alt=\"\" width=\"158\" height=\"180\" style=\"display: block; margin-left: auto; margin-right: auto;\"></td>\n</tr>\n</tbody>\n</table>\n</div>","status":0,"pv":7,"link":"","createdAt":"2026-01-26T17:40:35.000Z","updatedAt":"2026-01-27T15:01:13.000Z","field":{}}

article.tags------>

news------>[]

hot------>[]

imgs------>[]

pre------>{"id":33,"title":"经典形态头肩底原理、主图公式及选股公式","name":"指标公式","path":"/formula"}

next------>{"id":35,"title":"“三角形”整理形态的秘密,体现多空力量博弈,及主图公式","name":"指标公式","path":"/formula"}