SuperCMS 当前页面数据:

site-> {"name":"缠说・股经","domain":"cms.foryet.com","email":"ionce@163.com","wx":null,"icp":"京ICP备14010346号","code":"","title":"缠说• 股经","keywords":"通达信,同花顺,指标公式,选股公式,量化交易,量化炒股,量化策略,股票,财经,证券,金融,港股,行情,基金,债券,期货,外汇,科创板,保险,银行,博客,股吧,财迷,论坛,数据,stock,quote,news,fund,bank,blog,data,bbs,股票,投资,交易,行情,上市公司,大盘,上证指数,基金,直播,股评,荐股,博客 ,外汇,黄金,期货,港股,美股, 财经日历,银行,新闻, 证券","description":"股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享,“缠中说禅”博文。","json":""}

nav-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1,"createdAt":"01-27"}]

category-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1,"createdAt":"01-27"}]

friendlink-> [{"title":"SuperCMS官网","link":"https://cms.foryet.com"}]

static_url-> /web/default

frag--->{"weixinerweima":"<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\"></p>","PowerBy":"<p style=\"text-align: center; margin-top: 8px;\">Powder By <a href=\"http://cms.foryet.com\" target=\"_blank\" rel=\"noopener\">SuperCMS v3.0.14</a></p>","site_introduce":"<p><span style=\"font-size: 16px;\">股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享。欢迎扫码交流。</span></p>\n<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>"}

tag--->[{"id":5,"name":"经验交流","path":"jingyanjiaoliu","count":20},{"id":6,"name":"技术指标","path":"jishuzhibiao","count":16},{"id":3,"name":"指标公式","path":"formula","count":10},{"id":4,"name":"选股公式","path":"xgformula","count":5}]

position------>[{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"}]

navSub------>

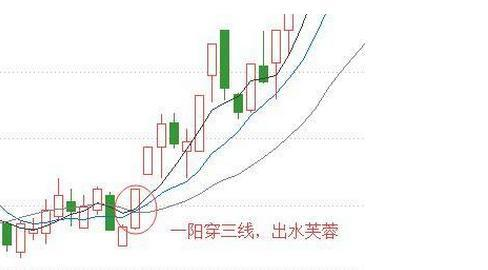

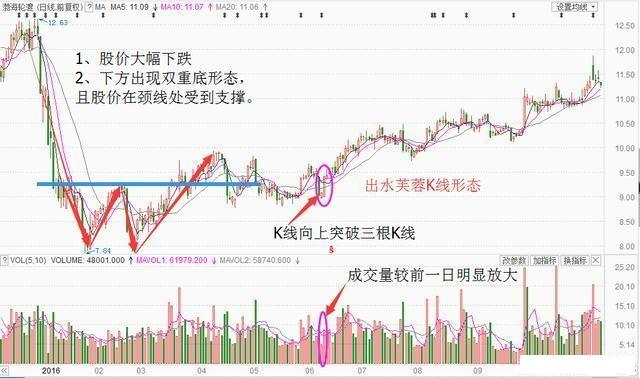

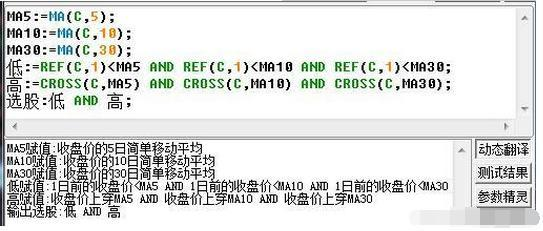

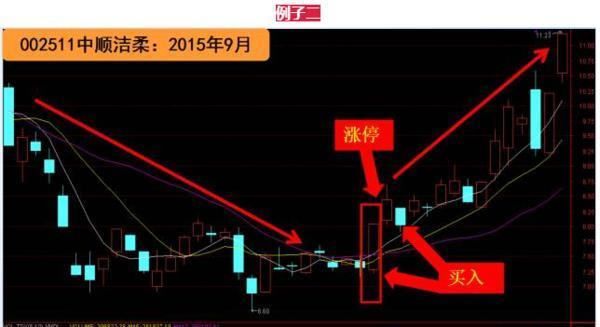

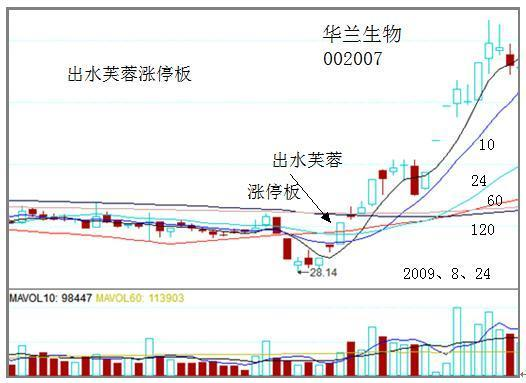

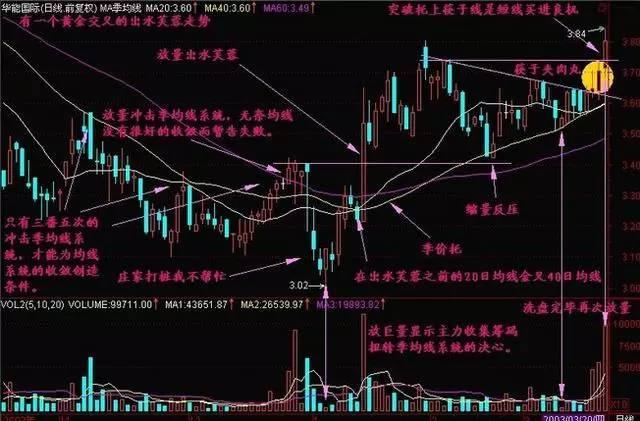

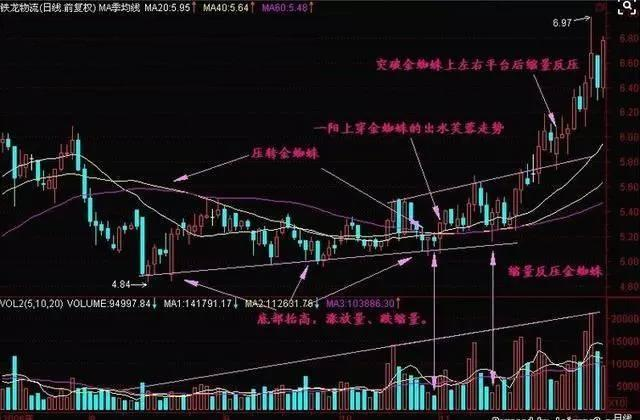

article------>{"id":10,"cid":3,"subCid":"","title":"最强势的反转形态——“出水芙蓉”,经常出现中线大牛股第一安全买点!","shortTitle":"","tagId":"6,5,3","attr":"","articleView":"","source":"","author":"","description":"炒股都想抓牛股,那么大家有没有去总结下牛股有什么形态特征呢,出水芙蓉是K线与均线结合的产物。指横盘整理或下跌过程中,在股票市场中有人把一阳穿三线称之为出水芙蓉。","img":"","content":"<p>炒股都想抓牛股,那么大家有没有去总结下牛股有什么形态特征呢,出水芙蓉是K线与均线结合的产物。指横盘整理或下跌过程中,在股票市场中有人把一阳穿三线称之为出水芙蓉。</p>\n<h2 id=\"h0\">K线形态特征</h2>\n<p>有一种形态正是为这两条真谛而生,这种形态名为“出水芙蓉”k线形态,看完这种形态的特征,大家就会懂,为什么这种形态完全符合这两条真谛。</p>\n<p>1、股价前期最好经过充分的调整或下跌。【股价经过大幅下跌之后,窄幅横盘震荡了很长一段时间,或者出现某种明显见底的信号,并且开始有所反弹迹象。】</p>\n<p>2、股价依据突破3条短期均线。(5日、10日、20日均线)</p>\n<p>3、突破时,伴随比较明显的成交增量。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240118002612.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<h2 id=\"h1\">应用法则</h2>\n<p>一根大阳线上穿三条均线,均线为多头排列,后势看涨,亦称“一阳穿三线”。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240118002541.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>出水芙蓉的出现,表明多头上攻势头强劲。主力将开始一轮新的征程,牛股狂欢将再一次拉开序幕!操作过程中要注意,如果出水芙蓉形态出现之后,周线形态不好或成交量并没有有效放大,那就要保持警惕,谨防主力骗线。如后期股价跌破大阳线起始点,就要止损出局了。</p>\n<h2 id=\"h2\">应用案例</h2>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240118002649.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>这股当时利用我出水芙蓉公式选出来的,出水芙蓉加上成交量放大,选出之后就进行布局,之后股价走势也是非常强势,沿着5日线攀升。</p>\n<h2 id=\"h3\">出水芙蓉选股公式</h2>\n<p>选股公式截图如下:</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240118002859.png\" alt=\"image.png\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>选股公式代码:</p>\n<pre><code class=\"hljs language-css\">MA5:=<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">5</span>); \nMA10:=<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">10</span>); \nMA30:=<span class=\"hljs-built_in\">MA</span>(C,<span class=\"hljs-number\">30</span>);\n低:=<span class=\"hljs-built_in\">REF</span>(C,<span class=\"hljs-number\">1</span>)<MA5 AND <span class=\"hljs-built_in\">REF</span>(C,<span class=\"hljs-number\">1</span>)<MA10 AND <span class=\"hljs-built_in\">REF</span>(C,<span class=\"hljs-number\">1</span>)<MA30;\t\n高:=<span class=\"hljs-built_in\">CROSS</span>(C,MA5) AND <span class=\"hljs-built_in\">CROSS</span>(C,MA10) AND <span class=\"hljs-built_in\">CROSS</span>(C,MA30);\t\n选股:低 AND 高;\n</code></pre>\n<p>这是出水芙蓉选股公式,配合上自己编写的量价齐升公式,成功率高达92%以上,基本上出手必红盘。</p>\n<p><strong>出水芙蓉的口诀:</strong></p>\n<p>出水芙蓉最可爱,穿越三条均线带。后市方向理应涨,杀入收益定不赖。</p>\n<h2 id=\"h4\">实战案例讲解</h2>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240118003105.png\" alt=\"image.png\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>华兰生物002007这只股票在2009年8月24日的时候,股价放量攻击涨停,一举突破所有均线压制,出现出水芙蓉形态。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240118003036.png\" alt=\"image.png\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<h2 id=\"h5\">操作要点</h2>\n<p><strong>激进:</strong>当日盘中,突破最后一条均线压力时即可买入;</p>\n<p><strong>稳健:</strong>涨停无法买入可待回踩五日均线附近时择时买入。</p>\n<p><strong>出水芙蓉的买点:</strong>当天就可以买入,或者第二天买入</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240118003152.png\" alt=\"image.png\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>在下跌趋势尚未转变时,要多次冲击季均线系统,才能为均线的收敛创造条件,在出水芙蓉前短期均线金叉,然后放量出水芙蓉,缩量回踩便是第一买点,进一步向上突破是第二短线买点。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240118003219.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>该股形成季价压后没有向下跌破压下平台,而是洗盘性质,在成交量的再次放大下,股价走出了一样上穿金蜘蛛这种出水芙蓉走势,宣告着新一轮上升行情的开始。</p>\n<h2 id=\"h6\">出水芙蓉的注意事项</h2>\n<p>1、出水芙蓉k线出现必须要同步大幅放量,否则诱多的成分较大;</p>\n<p>2、出水芙蓉k线出现在长期均线系统走平或向上发散才有效;</p>\n<p>3、出水芙蓉k线出现前须有箱体蓄势,否则不称为出水芙蓉;</p>\n<p>4、出水芙蓉k线出现,macd指标要快速上零轴,否则力度较弱,空间较小;</p>\n<p>5、出水芙蓉同步出现量能出水芙蓉共振力度更大</p>\n<p> </p>\n<p> </p>\n<div class=\"column is-12\" style=\"text-align: center;\">\n<table style=\"border-collapse: collapse; width: 68.6927%; height: 300.782px; border-width: 0px; margin-left: auto; margin-right: auto;\" border=\"1\"><colgroup><col style=\"width: 50.2582%;\"><col style=\"width: 49.7418%;\"></colgroup>\n<tbody>\n<tr style=\"height: 19.5938px;\">\n<td style=\"text-align: center; border-width: 0px; height: 19.5938px;\" colspan=\"2\"><strong><span style=\"font-size: 16px;\">感谢您的捐赠(鞠躬) ❤️</span></strong></td>\n</tr>\n<tr style=\"height: 199.594px;\">\n<td style=\"text-align: center; border-width: 0px; height: 199.594px;\">\n<p><img src=\"//img.foryet.com/uploads/2026/0125_31014606929_wxPay.png\" alt=\"\" width=\"200\" height=\"171\"></p>\n</td>\n<td style=\"border-width: 0px; height: 199.594px;\"><img src=\"//img.foryet.com/uploads/2026/0125_31014634042_zfbPay.png\" alt=\"\" width=\"158\" height=\"180\" style=\"display: block; margin-left: auto; margin-right: auto;\"></td>\n</tr>\n</tbody>\n</table>\n</div>","status":0,"pv":25,"link":"","createdAt":"2024-09-27T10:46:27.000Z","updatedAt":"2026-01-27T15:11:58.000Z","field":{}}

article.tags------>

news------>[]

hot------>[]

imgs------>[]

pre------>{"id":6,"title":"一文通过案例将MACD指标讲清楚","name":"指标公式","path":"/formula"}

next------>{"id":28,"title":"【转折K线】+【五大金叉共振】潜伏波段牛选股指标公式,捕捉股市起涨拐点牛股","name":"指标公式","path":"/formula"}