SuperCMS 当前页面数据:

site-> {"name":"缠说・股经","domain":"cms.foryet.com","email":"ionce@163.com","wx":null,"icp":"京ICP备14010346号","code":"","title":"缠说• 股经","keywords":"通达信,同花顺,指标公式,选股公式,量化交易,量化炒股,量化策略,股票,财经,证券,金融,港股,行情,基金,债券,期货,外汇,科创板,保险,银行,博客,股吧,财迷,论坛,数据,stock,quote,news,fund,bank,blog,data,bbs,股票,投资,交易,行情,上市公司,大盘,上证指数,基金,直播,股评,荐股,博客 ,外汇,黄金,期货,港股,美股, 财经日历,银行,新闻, 证券","description":"股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享,“缠中说禅”博文。","json":""}

nav-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1,"createdAt":"01-27"}]

category-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1,"createdAt":"01-27"}]

friendlink-> [{"title":"SuperCMS官网","link":"https://cms.foryet.com"}]

static_url-> /web/default

frag--->{"weixinerweima":"<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\"></p>","PowerBy":"<p style=\"text-align: center; margin-top: 8px;\">Powder By <a href=\"http://cms.foryet.com\" target=\"_blank\" rel=\"noopener\">SuperCMS v3.0.14</a></p>","site_introduce":"<p><span style=\"font-size: 16px;\">股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享。欢迎扫码交流。</span></p>\n<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>"}

tag--->[{"id":5,"name":"经验交流","path":"jingyanjiaoliu","count":20},{"id":6,"name":"技术指标","path":"jishuzhibiao","count":16},{"id":3,"name":"指标公式","path":"formula","count":10},{"id":4,"name":"选股公式","path":"xgformula","count":5}]

position------>[{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"}]

navSub------>

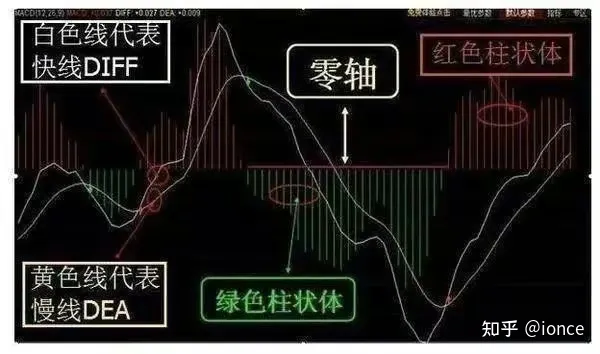

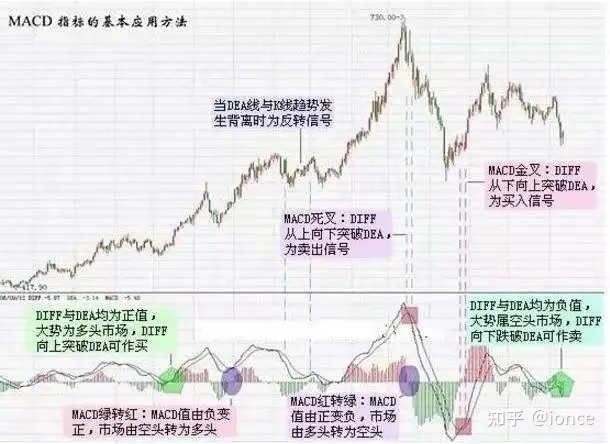

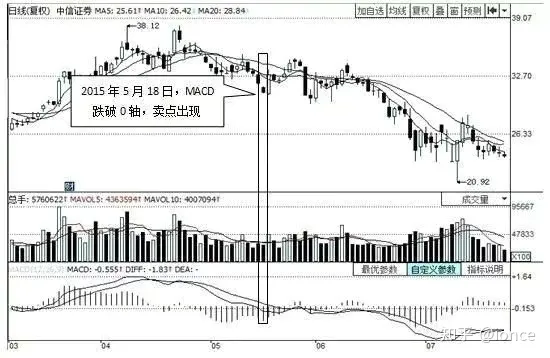

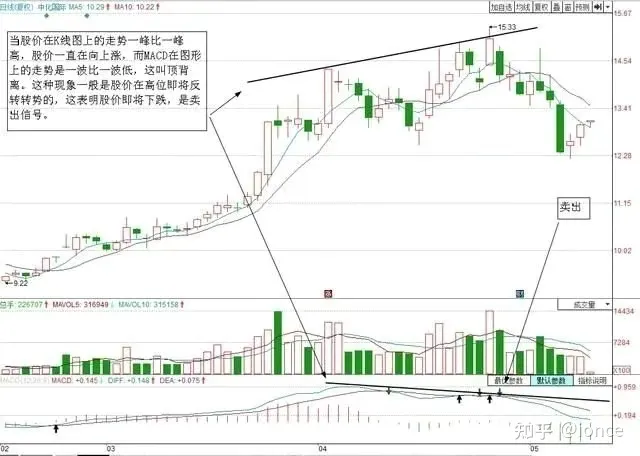

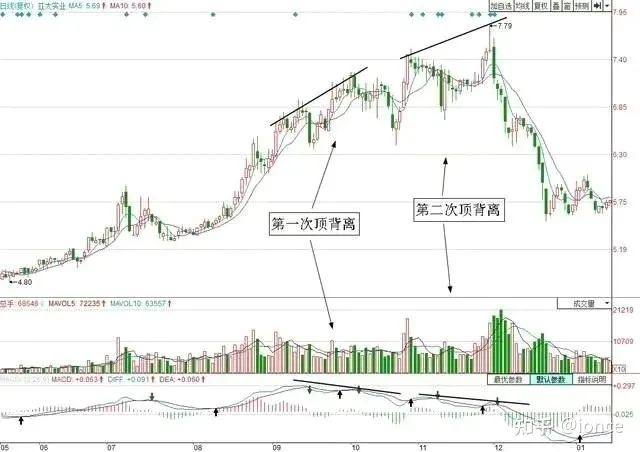

article------>{"id":6,"cid":3,"subCid":"","title":"一文通过案例将MACD指标讲清楚","shortTitle":"","tagId":"3,6,5","attr":"4,2","articleView":"","source":"","author":"","description":"MACD是由三条线和红绿色柱体构成,黑色线是DIF线,称之为快线;紫色线是DEA线,称为慢线。中间的一条直线是零轴,红色和绿色的柱体是能量柱。","img":"","content":"<p>MACD是由三条线和红绿色柱体构成,黑色线是DIF线,称之为快线;紫色线是DEA线,称为慢线。中间的一条直线是零轴,红色和绿色的柱体是能量柱。</p>\n<p>零轴:上方为正值区域,属于多方领域;下方为负值区域,属于空方领域。</p>\n<p>曲线:DIF为快线,DEA为慢线。</p>\n<p>柱体:红色柱线运行在正值区域;绿色柱线运行在负值区域。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20231227131904.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>1、当DIF和MACD的值为正值时,即均在0轴以上,属多头市场。若DIF线向上突破MACD线时,构成黄金交叉,为买入信号;若DIF线向下突破MACD时,构成死亡交叉,为回落信号,可以短线获利了结,不可以长线放空。</p>\n<p>2、当DIF和MACD的值为负值时,即均在0轴以下,属空头市场。若DIF线向下突破MACD线时,构成死亡交叉,为卖出信号;若DIF线向上突破MACD时,构成黄金交叉,为反弹信号,可以短线回补,不可以追涨。</p>\n<p>3、向下移动的MACD转为向上移动,DIF向上穿过MACD产生金叉,表明多方占有一定的优势。可分为两种现象:MACD在正值区域,即在0轴以上,此现象通常表示回档暂告结束,可以跟进做多;MACD在负伏区域,即在0轴以下,此现象通常表示反弹开始,可以用少最资金做反弹。</p>\n<p>4、向上移动的MACD转为向下移动,DIF向下穿过MACD产生死叉,表明空方占有一定的优势。</p>\n<p>5、当MACD与股价生产顶背离时,为卖出信号;底背离时,为买入信号。股价出现两个以上近期相对低点,而MACD并不况合出现新低点,可以买入;股价出现两个以上近期相对高点,而MACD并不配合出现新高点,可以卖出。</p>\n<p>6、在高位二次或二次以上死叉可能大跌,应及时停损离场;在低位二次或二次以上金叉可能大涨,应转变思维,做好做多准备。</p>\n<p>MACD基本应用方法(见图):</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20231227131930.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>1、MACD金叉:DIFF由下向上突破 DEA,为买入信号。</p>\n<p>2、MACD死叉:DIFF由上向下突破 DEA,为卖出信号。</p>\n<p>3、MACD红转绿:MACD值由正变负,市场由多头转为空头。</p>\n<p>4、MACD绿转红:MACD值由负变正,市场由空头转为多头。</p>\n<p>5、当 DEA线与 K线趋势发生背离时为反转信号。</p>\n<p>6、DIFF与 DEA均为正值,即都在零轴线以上时,大势属多头市场,DIFF向上突破 DEA,可作买。</p>\n<p>7、DIFF与 DEA均为负值,即都在零轴线以下时,大势属空头市场,DIFF向下跌破 DEA,可作卖。</p>\n<p>8、DEA在盘整局面时失误率较高,但如果配合 RSI及 KD指标可适当弥补缺点。</p>\n<p>MACD买卖五绝技</p>\n<p>绝一:MACD黄金叉.MACD指标在日线或周线图上,DIF和DEA线位于0轴处(临界点0附近形成的黄金叉为买入信号,果断买入股票将大涨)</p>\n<p>绝二:DIF与DEA在0轴上水平黏合在MACD指标中,DIF与DEA线位于0轴上方,并且平行黏合,绿柱小,且很少或无,即将翻红,出现第一根红柱的时候,为买入信号,果断买入。</p>\n<p>绝三:MACD二次带量增大(佛手)当一个波段的MACD红柱逐渐缩小后,即将要出绿柱,绿柱却没有出现,反而出现了再次增大的红柱现象,预示着股价新一轮上涨将要的开始,且比上一个波段的力度还要强。</p>\n<p>绝四:日线MACD最后一根绿柱买入法则股票下跌一轮后,做空动能逐渐衰竭,做多动能进一步增强,当做空动能衰竭到极限时,随后做多力量喷薄爆发!(前提条件是60分钟图必须出现1-2根红柱线),尤其是圆弧底的形态更为可靠)</p>\n<p>绝五:MACD洗盘结束的信号当一个波段的MACD红柱上攻缩短后,又收出1-4根很短的小绿柱并快速缩短(洗盘的绿柱都很短),在最后一根买入(洗盘结束的信号)接下来即将出现红柱,新的一轮上升行情即将展开。</p>\n<p>MACD实战技巧</p>\n<p>(1)MACD指标向下跌破0轴</p>\n<p>当DIFF线由上向下跌破0轴,表明空头行情即将悄然形成,是中长线第一个较为合适的卖出点,投资者应坚决择高派发;当DEA线由上向下突破0轴,表明空头行情逐渐变强,是中长线第二个较为合适的卖出点,此时投资者应该将仓位沽空。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20231227132016.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>如图所示,2015年5月上旬,中信证券的股价进入高位后开始震荡盘整。2015年5月18日,随着中信证券股价的一波调整,MACD指标的快线和慢线先后跌破0轴,这说明股价马上将启动一波下跌走势,尽管此时,股价并未启动快速下跌,投资者也应卖出手中股票。此后,该股又在高位震荡盘整了几日后,开始了一波快速杀跌之路。</p>\n<p>(2)MACD指标形成死叉</p>\n<p>当DIFF和DEA均为负值,DIFF线向下跌破DEA线,在0轴下方形成死叉,表示市场上做空力量较为强大,下跌行情仍将持续,此时投资者应该杀跌卖出。</p>\n<p>当DIFF和DEA均为正值,DIFF线向下跌破DEA线,在0轴上方形成死叉,表示市场上的做多氛围有所松懈,持股者有高位回吐的想法,股价可能滞涨回落,此时投资者需要借助其他技术指标来分析是否应该卖出。</p>\n<p>总而言之,MACD指标在0轴下方形成死叉才是可靠的卖出信号。</p>\n<p>如图所示,2015年8月25日,处于震荡整理的美的集团放量收出一根T形线。同时,DIFF线向下跌破DEA线,在0轴下方形成金叉,看到此情形,投资者不宜介入。2015年8月17日, MACD的两条指标线在0轴下方形成死叉,说明股价会出现下跌走势投资者宜迅速出清手中的股票。</p>\n<p>不该买的买了,指的是投资者在害怕踏空的心理状态下,在大盘或个股上升空间本不明显、可买可不买的市况状态下,轻易出手了。可事后证明,这种错误的选择往往导致错误的操作,要么使买入股票套牢在阶段性甚至是趋势性的顶部,而承受巨大的风险;要么使买入时机选择在了大盘或个股发生横盘之初而徒增时间成本。</p>\n<p>(3) 顶背离卖出</p>\n<p>价格上升到顶部的过程中,股价创新高,而MACD指标不增反降,这时就是顶背离。</p>\n<p>如图所示,中化国际的股价持续上升,而MACD指标走出一波比一波低的走势时,意味着顶背离出现,预示着股价可能在不久出现转头下行,可在死叉时卖出。</p>\n<p>当股价持续走高,而MACD指标却出现一波低于一波的走势时,意味着顶背离现象的出现,预示着股价将很快结束上涨返身下跌。</p>\n<p>股价经过长时间的上涨,上涨的空间已经非常小,再次向上创出新高的能量已经减弱。股价虽然仍然小幅度上涨,但是MACD指标同股价走出相反的趋势,开始由高位向下跌,高点不断下移,这样就形成顶背离形态,此时是卖出股票的好时机。即使MACD指标第一次背离时没有卖出股票,第二次背离的时候也应该卖出了。因为一般情况下顶背离都不会超过两次,如果交易者在第一次顶背离时没有卖出股票,第二次就必须卖出,否则很可能因为来不及卖出股票而在高位被套牢。当然,谨慎的交易者可以在MACD指标第一次背离时,先减仓卖出部分股票,等股价再次背离的时候卖出所有股票。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20231227132106.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>如图所示,亚太实业在上涨图中出现两次MACD指标和股价背离的情况。这说明多方力量有变弱的趋势,等空方力量复苏,股价将会见顶下跌。每次背离都是卖出股票的大好时机,在选择卖出价位方面,谨慎一点的交易者可以在指标出现顶背离后,立即卖出股票。激进一点的交易者可以在MACD指标下跌到0轴附近时,再卖出股票,此时是卖出股票的好时机。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20231227132136.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p>以上主要是对本轮反弹使用MACD的一些心得,MACD也不是万能的,当我们自认为掌握一种新方法跃跃欲试的时候往往是我们输钱的时候,因为行情复杂多变,我们看到的只是完美的一面,但其实使用MACD会碰到假金叉和背了又背这样失败的情况,所以积累的经验更为宝贵。</p>\n<p> </p>\n<p> </p>\n<div class=\"column is-12\" style=\"text-align: center;\">\n<table style=\"border-collapse: collapse; width: 68.6927%; height: 300.782px; border-width: 0px; margin-left: auto; margin-right: auto;\" border=\"1\"><colgroup><col style=\"width: 50.2582%;\"><col style=\"width: 49.7418%;\"></colgroup>\n<tbody>\n<tr style=\"height: 19.5938px;\">\n<td style=\"text-align: center; border-width: 0px; height: 19.5938px;\" colspan=\"2\"><strong><span style=\"font-size: 16px;\">感谢您的捐赠(鞠躬) ❤️</span></strong></td>\n</tr>\n<tr style=\"height: 199.594px;\">\n<td style=\"text-align: center; border-width: 0px; height: 199.594px;\">\n<p><img src=\"//img.foryet.com/uploads/2026/0125_31014606929_wxPay.png\" alt=\"\" width=\"200\" height=\"171\"></p>\n</td>\n<td style=\"border-width: 0px; height: 199.594px;\"><img src=\"//img.foryet.com/uploads/2026/0125_31014634042_zfbPay.png\" alt=\"\" width=\"158\" height=\"180\" style=\"display: block; margin-left: auto; margin-right: auto;\"></td>\n</tr>\n</tbody>\n</table>\n</div>","status":0,"pv":9,"link":"","createdAt":"2024-09-17T10:53:54.000Z","updatedAt":"2024-09-17T10:53:54.000Z","field":{}}

article.tags------>

news------>[]

hot------>[]

imgs------>[]

pre------>

next------>{"id":10,"title":"最强势的反转形态——“出水芙蓉”,经常出现中线大牛股第一安全买点!","name":"指标公式","path":"/formula"}