SuperCMS 当前页面数据:

site-> {"name":"缠说・股经","domain":"cms.foryet.com","email":"ionce@163.com","wx":null,"icp":"京ICP备14010346号","code":"","title":"缠说• 股经","keywords":"通达信,同花顺,指标公式,选股公式,量化交易,量化炒股,量化策略,股票,财经,证券,金融,港股,行情,基金,债券,期货,外汇,科创板,保险,银行,博客,股吧,财迷,论坛,数据,stock,quote,news,fund,bank,blog,data,bbs,股票,投资,交易,行情,上市公司,大盘,上证指数,基金,直播,股评,荐股,博客 ,外汇,黄金,期货,港股,美股, 财经日历,银行,新闻, 证券","description":"股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享,“缠中说禅”博文。","json":""}

nav-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1}]

category-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1}]

friendlink-> [{"title":"SuperCMS官网","link":"https://cms.foryet.com"}]

static_url-> /web/default

frag--->{"weixinerweima":"<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\"></p>","PowerBy":"<p style=\"text-align: center; margin-top: 8px;\">Powder By <a href=\"http://cms.foryet.com\" target=\"_blank\" rel=\"noopener\">SuperCMS v3.0.14</a></p>","site_introduce":"<p><span style=\"font-size: 16px;\">股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享。欢迎扫码交流。</span></p>\n<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>"}

tag--->[{"id":5,"name":"经验交流","path":"jingyanjiaoliu","count":20},{"id":6,"name":"技术指标","path":"jishuzhibiao","count":16},{"id":3,"name":"指标公式","path":"formula","count":10},{"id":4,"name":"选股公式","path":"xgformula","count":5}]

position------>[{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"}]

navSub------>

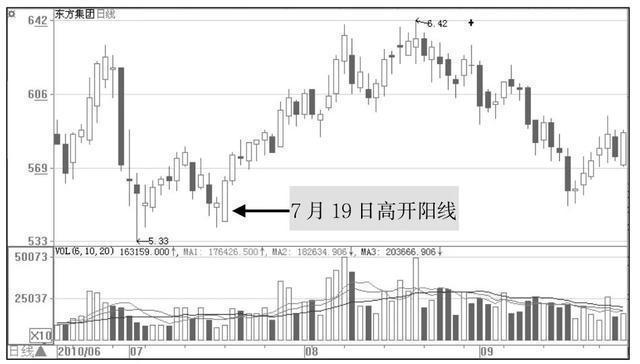

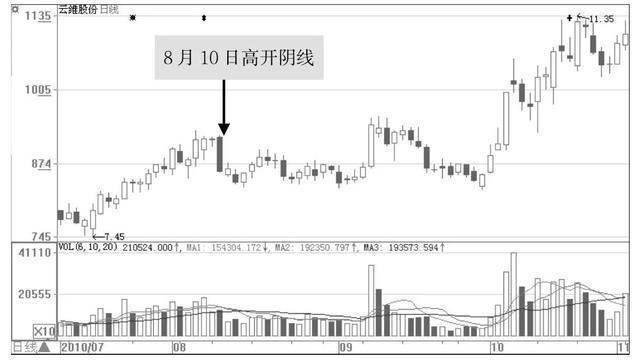

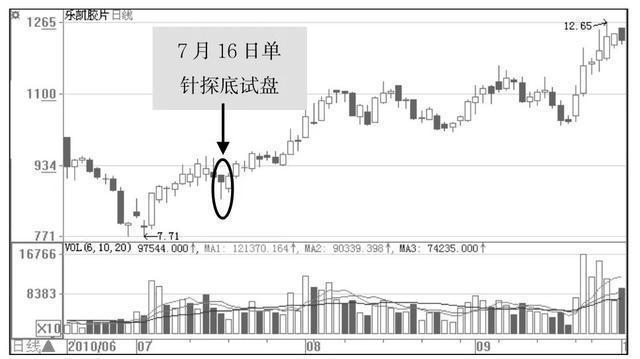

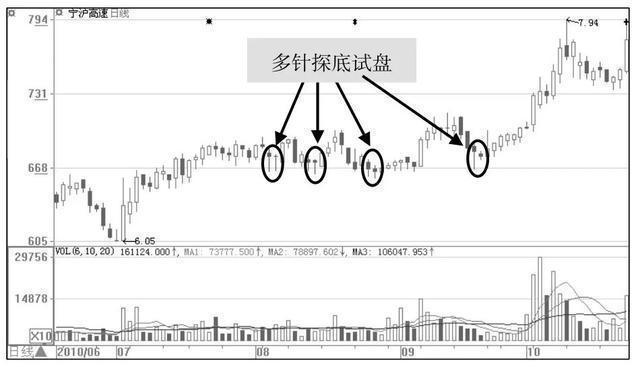

article------>{"id":2,"cid":2,"subCid":"","title":"如何判断主力吸筹完成后的试盘","shortTitle":"","tagId":"6,5","attr":"4,2","articleView":"","source":"","author":"","description":"主力吸货完毕之后,并不是马上进入拉升状态。虽然此时提升的心情十分急切,但还要最后一次对盘口进行全面的试验,来确认其目的。","img":"","content":"<p><strong>主力吸货完毕之后,并不是马上进入拉升状态。虽然此时提升的心情十分急切,但还要最后一次对盘口进行全面的试验,其目的是:</strong></p>\n<p>1、测试盘内筹码锁定的好坏。</p>\n<p>2、测试盘内大户或其它主力情况。</p>\n<p>3、测试浮筹情况,测定市场追涨杀跌意愿。</p>\n<p>试盘的种种情况探明了市场中的持仓情况。股性死板没有关系,在大盘弱势中逞强,强势中压盘就能很快地活跃起来。</p>\n<h2 id=\"h0\">试盘的常规方式</h2>\n<p>1、平衡市向上下拉升或打压试盘。</p>\n<p>2、在强势市拉高后不参与试盘。</p>\n<p>3、在弱势市拉高或压低试盘。</p>\n<p>4、利用颈线、趋势线、黄金位、均线、通道上下轨等技术试盘。</p>\n<p>5、利用利好利空消息拉升或打压试盘;利用板块整体启动或调整等试盘。</p>\n<p>在实际操作过程中,一般是主力用几笔大买单,把股价推高,看看市场的反应。主力将大买单放在买二或买三上,推动股价上扬,此时看看有没有人在买一上抢货,如果无人理,就说明盘面较轻,但股性较差;如果有人抢盘,而且盘子较轻,就成功了一半。紧接着主力在拉升到一定的价位时,忽然撤掉下面托盘的买单,股价突然地回落。而后,主力再在卖一上压下一个大卖单,这时股价轻易下挫,这说明无其它主力吃货。在推升过程中,盘中有较大的抛压,这时主力大多先将买盘托至阻力价位之前,然后忽然撤掉托盘买单,使股价下挫。如此往复,高点不断降低,该股的持有者会以为反弹即将结束。突然主力打出一个新高之后,又急转直下,此时比前期高点高,眼看很快要跌回原地,非盘再不敢不减仓了,于是集中的抛单被拆散了。</p>\n<h2 id=\"h1\">主力试盘的形态特征</h2>\n<p><strong>1、高开阴线</strong></p>\n<p>“高开阴线”与“低开阳线”刚好相反,它是指开盘后股价大幅跳空高开,但高开后股价并没有高走,而是出现震荡着向下滑落的态势,收盘时收出一根高开低走的大阴线。</p>\n<p>主力抓住了一般散户买进一只股票,不可能不赚钱就快速割肉出局的心理,于是让股价大幅高开低走,并且在收盘的时候收出一根大阴线。主力通过这样的方式,就能测试出那些处于犹豫和徘徊状态的散户们的心态。如果股价在大幅高开低走后出现大量抛盘,就说明盘中的浮动筹码比较多,散户的持股心态不是很稳定,此时主力就会继续下探试盘寻找支撑点;而如果股价大幅高开低走后,盘面上的卖盘很稀少,则说明盘中的散户持股心态很坚定,那么主力接下来就会进入拉升股价的阶段。</p>\n<p>散户在跟主力过程中若遇到这种方式试盘的个股,应该特别留意盘面的动向,一旦股价开始走强,就要立刻进场操作。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240116015116.png\" alt=\"image.png\"></p>\n<p><strong>2、低开阳线</strong></p>\n<p>从字面意思理解“低开阳线”就是指股价虽然以低开形成开盘,但却收出一根阳线。其实“低开阳线”是指股价以大幅度低开的方式开盘,一般低开的幅度为3%以上,开盘后股价一路走高,收盘时最终收出一根阳线实体,当天的开盘价即为当天的最低价。</p>\n<p>主力之所以采用低开阳线的方式试盘,主要出于两点原因。第一就是主力可以在大幅度低开的过程中收集到廉价的筹码,又不会引来大量的跟风盘,也不会在试盘过程中流失筹码。第二点原因就是主力可以测试出筹码的稳定性和盘面的支撑力度。</p>\n<p>散户在跟主力过程中若遇到这种方式试盘的个股,应该密切关注低开试盘后的股价走势动态。如果试盘后股价开始走强,说明主力开始进入拉升股价阶段,此时散户就可以进场参与操作了。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240116015040.png\" alt=\"image.png\"></p>\n<p><strong>3、单针探底</strong></p>\n<p>所谓单针探底是指主力试盘时让股价只维持一瞬间的快速下探,然后就快速地将股价拉起来,在日K线图上形成带有长下影线的K线形态。这种试盘方式非常隐蔽,主力就是怕那些技术功底较深的散户识破他们的试盘意图,然后进场与他们抢筹码。</p>\n<p>主力采用单针探底的方式试盘可以起到两个作用。</p>\n<p>第一个作用就是在股价下探的过程中,主力可以测试股价下档的支撑力度以及持股者的持股信心。如果下档支撑力度很强,那么股价很难快速地跌下去;如果持股者的持股信心很坚定,那么盘面上就不会出现很多卖盘。</p>\n<p>第二个作用就是可以测试出场外资金对该股的关注度。如果该股引起了场外资金的高度关注,那么在股价快速下跌的过程中,就会有很多散户进场抢筹码,此时的成交量也有明显的放大。</p>\n<p>散户若遇到主力用这种方式试盘的个股,千万不要盲目地在股价快速下探的时候进场操作,因为主力在试盘过程中,若测试出下档支撑力度不强,或是盘中恐慌性筹码较多,就会继续向下试盘,中小投资者若盲目介入就会被主力拖住。所以散户应仔细观察盘面的情况,若发现股价在探底的过程中抛盘不大,下档买盘很积极,同时在股价下探的过程中成交量明显萎缩,且第二天股价又以阳线报收,这个时候散户就可以进场放心买入了。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240116015155.png\" alt=\"image.png\"></p>\n<p><strong>4、多针探底</strong></p>\n<p>顾名思义,多针探底是指主力建仓后,通过多次单针探底的方式,来反复试探股价在低位的承接能力以及盘中的浮动筹码情况。在主力进行多针探底试盘过程中,股价在日 K线图上会出现多次单针探底的形态,也就是说会多次出现带长下影线的K线形态。</p>\n<p>主力将股价反复地下探到一个低位区域,如果每次都能出现积极的买盘来支撑股价,且这个区域盘中的抛盘相当少,那么就说明股价在这个区域有明显的支撑。</p>\n<p>散户在跟主力过程中若遇到多针探底试盘方式的个股,千万不要盲目跟进。因为多针探底是主力反复探底,主力只有测试出股价在这个区域的支撑力度相当强之后,才会选择进入拉升阶段。所以,散户不要认为股价马上就会上涨,应该等到主力探明底部之后,出现向上走强的信号时再介入。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20240116015230.png\" alt=\"image.png\"></p>","status":0,"pv":35,"link":"","createdAt":"2024-09-13T22:55:57.000Z","updatedAt":"2024-09-13T22:55:57.000Z","field":{}}

article.tags------>

news------>[{"id":45,"title":"筹码峰识别主力及回踩一线天","shortTitle":"","img":"//img.foryet.com/uploads/2026/0127_31142466152_mceclip0.jpg","createdAt":"2026-01-27T10:32:13.000Z","description":"筹码峰可以帮助我们及时发现阶段性底部筹码集中的个股,跟随主力在拉升前介入,那如何通过筹码峰识别主力有建仓并拉升的意向呢?","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":42,"title":"如何捕捉极冰行情后的普涨机会?","shortTitle":"","img":"https://chanshuo.onrender.com/upload/image_20240424012936.png","createdAt":"2026-01-27T09:23:15.000Z","description":"市场在某交易日出现几百甚至千股涨停的局面,这就是我们所谓的普涨行情。本文将介绍关于如何参与做好普反行情中的机会。","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":27,"title":"如何通过周线、月线判断股票主升浪开始?","shortTitle":"","img":"https://chanshuo.onrender.com/upload/ac6ac02bbb0e93ee61a79845e9f3ffd.jpg","createdAt":"2026-01-26T16:49:18.000Z","description":"","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":26,"title":"炒股必备技巧之低位启动低吸法","shortTitle":"","img":"","createdAt":"2026-01-26T10:32:57.000Z","description":"","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":25,"title":"只有少数人知道的K线黑马形态——美人肩,遇到重仓买入,主力抬轿帮你拉升!","shortTitle":"","img":"","createdAt":"2026-01-26T10:29:32.000Z","description":"","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":24,"title":"散户炒股法宝――学会画“趋势线”","shortTitle":"","img":"","createdAt":"2026-01-26T10:27:22.000Z","description":"","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":23,"title":"股市最可靠的“银山谷”买入法,看到这一走势大胆选择满仓!","shortTitle":"","img":"","createdAt":"2026-01-26T10:12:30.000Z","description":"","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":22,"title":"主力拉高建仓洗盘再启动的首板买入方法","shortTitle":"","img":"","createdAt":"2026-01-26T10:07:19.000Z","description":"","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":21,"title":"全美交易冠军马克·米勒维尼的核心交易模式VCP形态的指标公式及选股公式","shortTitle":"","img":"https://chanshuo.onrender.com/upload/image_20240510030130.png","createdAt":"2024-12-09T23:17:35.000Z","description":"VCP形态的英文”Volatility Contraction Pattern”的缩写,意思是“波动收缩形态”。VCP形态是全美交易冠军马克·米勒维尼的核心交易模式之一,在其著作《股票魔法师》中有详细介绍。","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":18,"title":"股票交易中的分歧,一致和分歧转一致及实例分析","shortTitle":"","img":"","createdAt":"2024-12-09T23:16:07.000Z","description":"今天说下股票交易中的分歧,一致和分歧转一致,发现很多人不知道怎么看分歧和一致。","pinyin":"articles","name":"谈股论经","path":"/articles"}]

hot------>[{"id":21,"title":"全美交易冠军马克·米勒维尼的核心交易模式VCP形态的指标公式及选股公式","path":"/articles"},{"id":14,"title":"股票出现“仙人指路”形态,说明主力正在强势洗盘,股价或将喷发式上涨","path":"/articles"},{"id":2,"title":"如何判断主力吸筹完成后的试盘","path":"/articles"},{"id":18,"title":"股票交易中的分歧,一致和分歧转一致及实例分析","path":"/articles"},{"id":9,"title":"板块龙头的判断及第一买点的方法","path":"/articles"},{"id":45,"title":"筹码峰识别主力及回踩一线天","path":"/articles"},{"id":27,"title":"如何通过周线、月线判断股票主升浪开始?","path":"/articles"},{"id":7,"title":"首板第二天溢价规则","path":"/articles"},{"id":25,"title":"只有少数人知道的K线黑马形态——美人肩,遇到重仓买入,主力抬轿帮你拉升!","path":"/articles"},{"id":26,"title":"炒股必备技巧之低位启动低吸法","path":"/articles"}]

imgs------>[{"id":45,"title":"筹码峰识别主力及回踩一线天","shortTitle":"","img":"//img.foryet.com/uploads/2026/0127_31142466152_mceclip0.jpg","createdAt":"2026-01-27T10:32:13.000Z","description":"筹码峰可以帮助我们及时发现阶段性底部筹码集中的个股,跟随主力在拉升前介入,那如何通过筹码峰识别主力有建仓并拉升的意向呢?","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":42,"title":"如何捕捉极冰行情后的普涨机会?","shortTitle":"","img":"https://chanshuo.onrender.com/upload/image_20240424012936.png","createdAt":"2026-01-27T09:23:15.000Z","description":"市场在某交易日出现几百甚至千股涨停的局面,这就是我们所谓的普涨行情。本文将介绍关于如何参与做好普反行情中的机会。","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":27,"title":"如何通过周线、月线判断股票主升浪开始?","shortTitle":"","img":"https://chanshuo.onrender.com/upload/ac6ac02bbb0e93ee61a79845e9f3ffd.jpg","createdAt":"2026-01-26T16:49:18.000Z","description":"","pinyin":"articles","name":"谈股论经","path":"/articles"},{"id":21,"title":"全美交易冠军马克·米勒维尼的核心交易模式VCP形态的指标公式及选股公式","shortTitle":"","img":"https://chanshuo.onrender.com/upload/image_20240510030130.png","createdAt":"2024-12-09T23:17:35.000Z","description":"VCP形态的英文”Volatility Contraction Pattern”的缩写,意思是“波动收缩形态”。VCP形态是全美交易冠军马克·米勒维尼的核心交易模式之一,在其著作《股票魔法师》中有详细介绍。","pinyin":"articles","name":"谈股论经","path":"/articles"}]

pre------>

next------>{"id":7,"title":"首板第二天溢价规则","name":"谈股论经","path":"/articles"}