SuperCMS 当前页面数据:

site-> {"name":"缠说・股经","domain":"cms.foryet.com","email":"ionce@163.com","wx":null,"icp":"京ICP备14010346号","code":"","title":"缠说• 股经","keywords":"通达信,同花顺,指标公式,选股公式,量化交易,量化炒股,量化策略,股票,财经,证券,金融,港股,行情,基金,债券,期货,外汇,科创板,保险,银行,博客,股吧,财迷,论坛,数据,stock,quote,news,fund,bank,blog,data,bbs,股票,投资,交易,行情,上市公司,大盘,上证指数,基金,直播,股评,荐股,博客 ,外汇,黄金,期货,港股,美股, 财经日历,银行,新闻, 证券","description":"股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享,“缠中说禅”博文。","json":""}

nav-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1}]

category-> [{"id":1,"pid":0,"name":"首页","pinyin":"home","path":"/home","orderBy":1,"target":"0","status":"0","listView":"index.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"home","level":1},{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"},{"id":3,"pid":0,"name":"指标公式","pinyin":"formula","path":"/formula","orderBy":3,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"formula","level":1,"createdAt":"01-27"},{"id":11,"pid":0,"name":"数据集锦","pinyin":"datus","path":"/datus","orderBy":4,"target":"0","status":"0","listView":"stockdata.html","articleView":"stockdata.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"datus","level":1,"createdAt":"01-26"},{"id":7,"pid":0,"name":"关于我们","pinyin":"about","path":"/about","orderBy":6,"target":"0","status":"0","listView":"article.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"1","tag":"about","level":1}]

friendlink-> [{"title":"SuperCMS官网","link":"https://cms.foryet.com"}]

static_url-> /web/default

frag--->{"weixinerweima":"<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\"></p>","PowerBy":"<p style=\"text-align: center; margin-top: 8px;\">Powder By <a href=\"http://cms.foryet.com\" target=\"_blank\" rel=\"noopener\">SuperCMS v3.0.14</a></p>","site_introduce":"<p><span style=\"font-size: 16px;\">股票交易技术交流,指标公式,选股公式编写,股票投资经验汇集,量化交易策略编写及技术分享。欢迎扫码交流。</span></p>\n<p><img src=\"//img.foryet.com/uploads/2026/0120_30581810801_mceu_54808294511768921010564.png\" width=\"200\" height=\"200\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>"}

tag--->[{"id":5,"name":"经验交流","path":"jingyanjiaoliu","count":20},{"id":6,"name":"技术指标","path":"jishuzhibiao","count":16},{"id":3,"name":"指标公式","path":"formula","count":10},{"id":4,"name":"选股公式","path":"xgformula","count":5}]

position------>[{"id":2,"pid":0,"name":"谈股论经","pinyin":"articles","path":"/articles","orderBy":2,"target":"0","status":"0","listView":"list.html","articleView":"article.html","seoTitle":"","seoKeywords":"","seoDescription":"","type":"0","tag":"articles","level":1,"createdAt":"01-27"}]

navSub------>

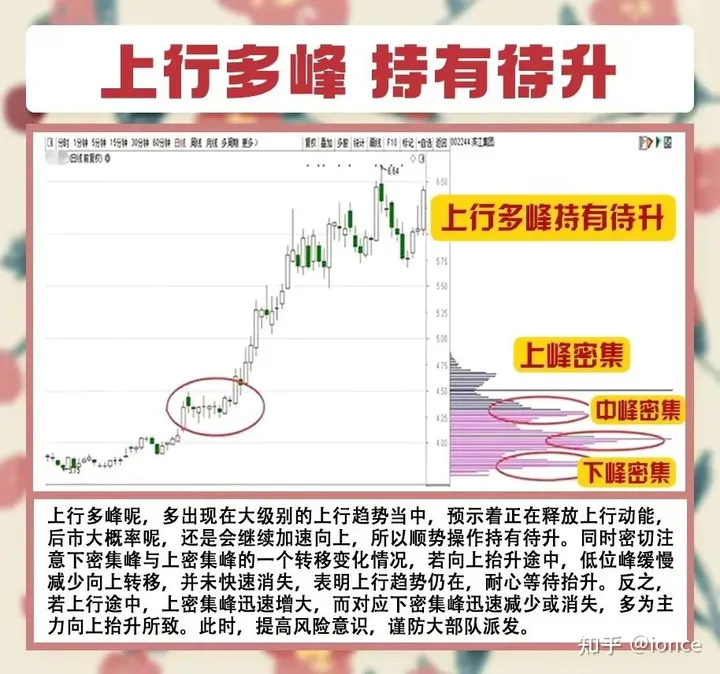

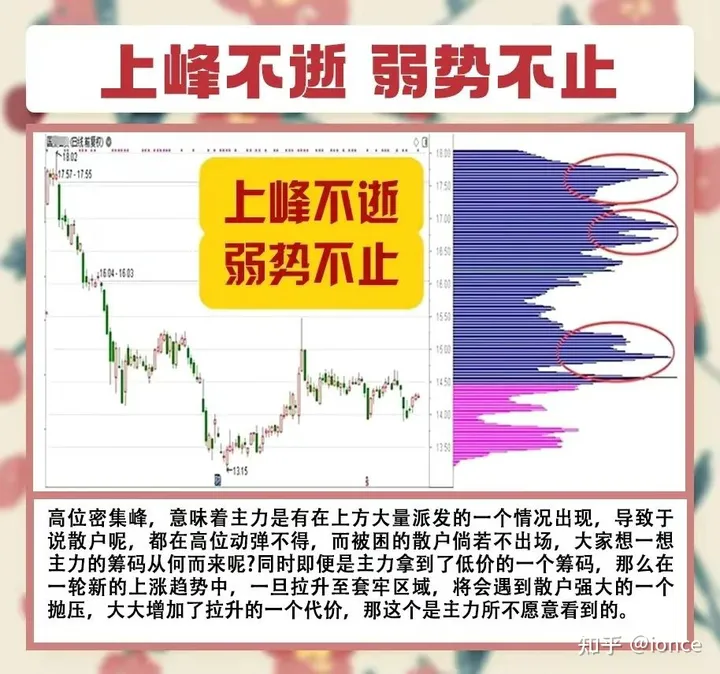

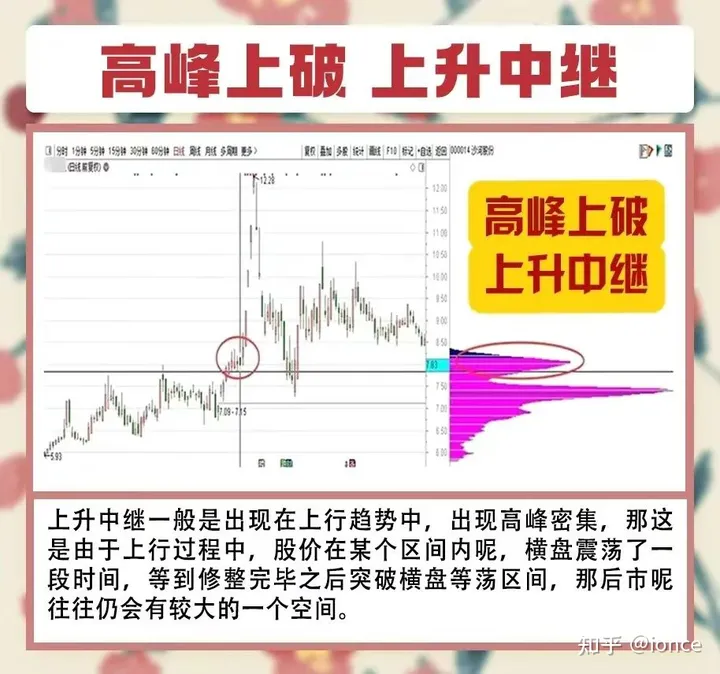

article------>{"id":45,"cid":2,"subCid":null,"title":"筹码峰识别主力及回踩一线天","shortTitle":"","tagId":"6,5","attr":"2,4","articleView":"","source":"","author":"","description":"筹码峰可以帮助我们及时发现阶段性底部筹码集中的个股,跟随主力在拉升前介入,那如何通过筹码峰识别主力有建仓并拉升的意向呢?","img":"//img.foryet.com/uploads/2026/0127_31142466152_mceclip0.jpg","content":"<p>筹码峰可以帮助我们及时发现阶段性底部筹码集中的个股,跟随主力在拉升前介入,那如何通过筹码峰识别主力有建仓并拉升的意向呢?建议收藏研究!</p>\n<p><img src=\"//img.foryet.com/uploads/2026/0127_31142466152_mceclip0.jpg\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<h2 id=\"h0\">筹码峰的基础知识</h2>\n<p>筹码分布指的是投资者在不同价位上的持股数量,通过筹码可以判断各个价位的资金持有成本</p>\n<h2 id=\"h1\">筹码分布三要素</h2>\n<p>①筹码颜色:红色代表获利,蓝色代表套牢</p>\n<p>②筹码长短:筹码柱长短代表该价位持股人数的多少</p>\n<p>③集中度:代表当天流通股被多少人持有,集中度数值越小代表筹码越集中,90%和70%筹码区间的集中度都小于10%的时候,意味着该支个股的筹码高度集中</p>\n<h2 id=\"h2\">如何识别主力筹码</h2>\n<p>①获利超过30%还不抛的筹码,必定是主力筹码</p>\n<p>②股价剧烈震荡,仍然不动的筹码,就是主力的筹码</p>\n<p>③套牢盘解套之后仍然不出的筹码,代表主力锁仓</p>\n<h2 id=\"h3\">筹码峰的运用</h2>\n<p>1、压力:如果大量筹码在上方,称为“压力”。意味着股价上方套牢盘比较大,后期股价上涨压力相对较大</p>\n<p>2、支撑:股价下方峰值比较大,意味着股价下方支撑力度比较强,股价上方套牢盘比较小,有利于股价后期上涨</p>\n<p>3、如果筹码分布图比较分散,并且价格区间比较分散,代表个股散户居多,大概率主力没有形成有效持仓</p>\n<p>回踩一线天模式 回踩一线天是指出现一线天筹码之后,因为持筹资金的分歧,导致股价出现了回落,但因为一线天筹码的超强属性加持,后续股价依然会逐渐反掸拉升。在这个拉升之前,就可以根据实际情况做一线天筹码股回踩之后的低吸,这就是回踩一线天的概念。回踩一线天模式的本质就是资金介入程度和板块的轮动,往大了说就是市场情绪周期规律。利用龙头打开空间之后交易者往往是积极的,直到积极演化为狂热而结束。我们看到这一波无论龙头走势还是各题材走势,在龙头没走出高度这前,分歧都非常大,人心可见一斑。市场反复的分歧、一致、再分歧、再一致,机会往往孕育在短暂的分歧之中而每次短暂的一致反倒是风险。而利用妖股打开空间,后排资金介入极深的个股就会伴随一线天筹码有反复震荡回踩低吸的超短机会,这就是回踩一线天的本质。回踩一线天分为第一、二、三、四等,根据个股的股性和形态不一样,可以制定详细的买入方法。</p>\n<p>对于新手朋友,以上筹码峰的基础知识大家先消化,再结合图文案例,相信大家对筹码峰会有一个初步的认识。筹码峰在我的交易体系当中占有非常重要的分量,如果大家感兴趣,可以点赞留言。</p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20231227130507.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20231227130530.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p><img src=\"https://chanshuo.onrender.com/upload/image_20231227130549.png\" alt=\"image.png\" width=\"600\" style=\"display: block; margin-left: auto; margin-right: auto;\"></p>\n<p> </p>\n<p> </p>\n<div class=\"column is-12\" style=\"text-align: center;\">\n<table style=\"border-collapse: collapse; width: 68.6927%; height: 300.782px; border-width: 0px; margin-left: auto; margin-right: auto;\" border=\"1\"><colgroup><col style=\"width: 50.2582%;\"><col style=\"width: 49.7418%;\"></colgroup>\n<tbody>\n<tr style=\"height: 19.5938px;\">\n<td style=\"text-align: center; border-width: 0px; height: 19.5938px;\" colspan=\"2\"><strong><span style=\"font-size: 16px;\">感谢您的捐赠(鞠躬) ❤️</span></strong></td>\n</tr>\n<tr style=\"height: 199.594px;\">\n<td style=\"text-align: center; border-width: 0px; height: 199.594px;\">\n<p><img src=\"//img.foryet.com/uploads/2026/0125_31014606929_wxPay.png\" alt=\"\" width=\"200\" height=\"171\"></p>\n</td>\n<td style=\"border-width: 0px; height: 199.594px;\"><img src=\"//img.foryet.com/uploads/2026/0125_31014634042_zfbPay.png\" alt=\"\" width=\"158\" height=\"180\" style=\"display: block; margin-left: auto; margin-right: auto;\"></td>\n</tr>\n</tbody>\n</table>\n</div>","status":0,"pv":8,"link":"","createdAt":"2026-01-27T10:32:13.000Z","updatedAt":"2026-01-27T14:21:09.000Z","field":{}}

article.tags------>

news------>[]

hot------>[]

imgs------>[]

pre------>{"id":42,"title":"如何捕捉极冰行情后的普涨机会?","name":"谈股论经","path":"/articles"}

next------>